Intro

Vanguard Australia recently announced that they are updating their fee structure on their Vanguard Personal Investor Australia Product – and to cut to the chase, they’ve made some pretty significant changes. I wasn’t super impressed with the product when it launched in 2020, which I covered in my original Vanguard Personal Investor review. But with these product changes that went live on the 18th August 2021 (or already live depending on when you are watching this), I wanted to do an updated review to cover what’s changed and whether its worth using or not.

So in the post, in addition to going over the recent changes – I’ll do a detailed review of the Vanguard Personal Investor offering in Australia, and how it stacks up compared to purchasing Vanguard ETFs through another stock broker, and also how it compares to investing directly into Vanguard Retail or Wholesale Funds. This way you will know in exactly which situations it will be optimal for you to be using Vanguard Personal Investor in Australia, as it is not that straightforward.

Summary of Vanguard

For those of you who don’t know who or what Vanguard is, I’ll keep this brief but Vanguard is a fund manager and is actually the largest provider of mutual funds in the world. And in Australia, they are by far the most popular fund manager and ETF manager in the country. They’ve got 82 funds with over $164B of assets under management, they also won a bunch of awards related to investing and managed funds.

And in terms of the Vanguard Personal Investor product, it’s essentially a Vanguard created ASX stock brokerage account for investing in Vanguard funds or other ASX-listed shares or ETFs.

What’s actually changing with the new fee structure

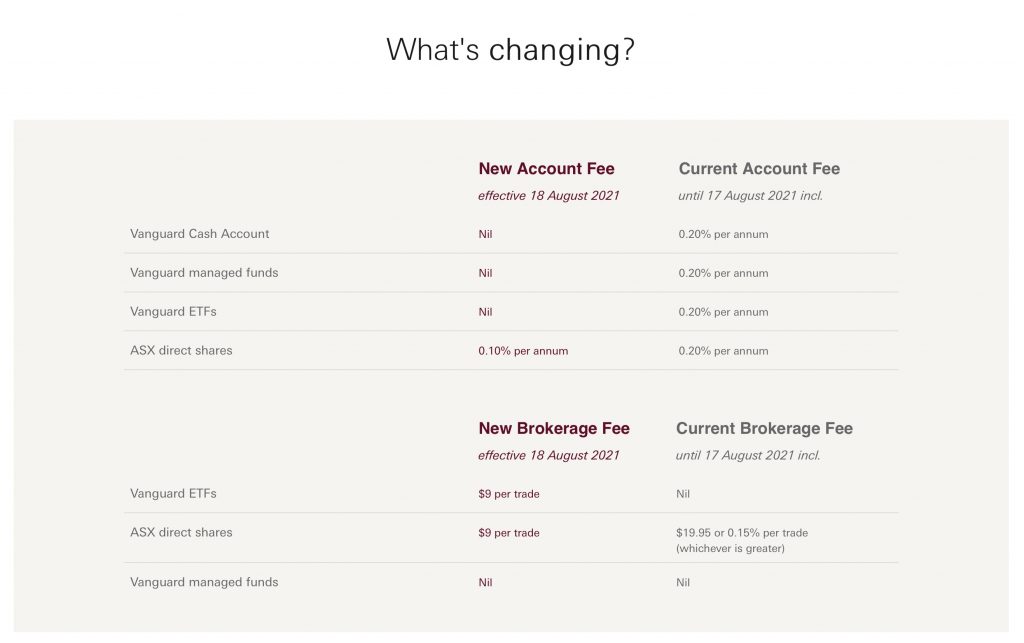

So now to get into what’s changing with the new fee structure, at a high level it seems they’ve completely pivoted the product to be a lot more attractive for buying standard ASX shares or ETFs. But I’ll go through the changes line by line and give my thoughts.

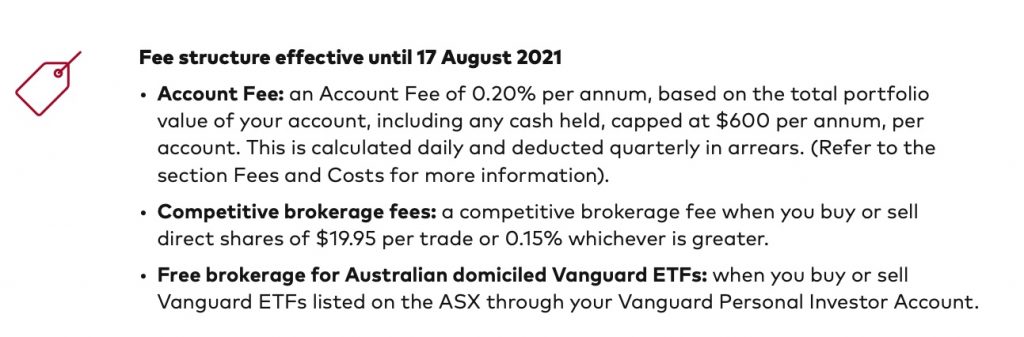

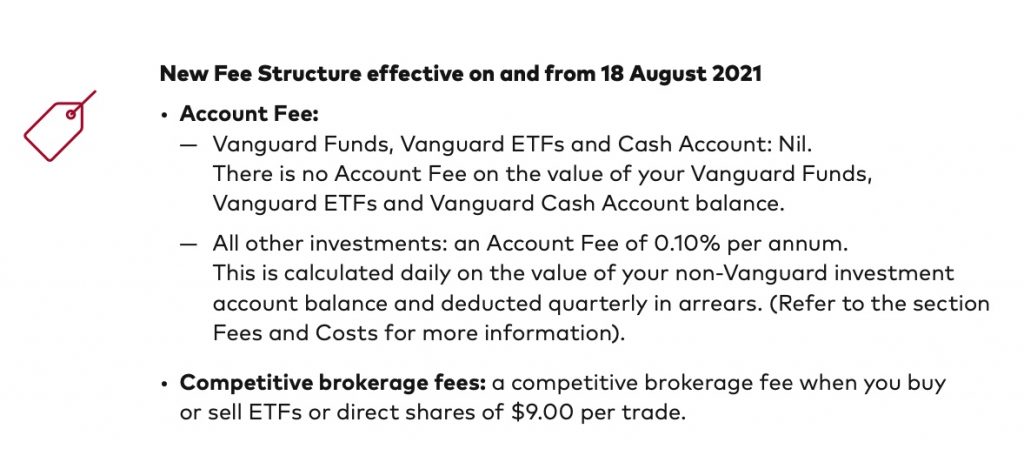

- Completely removing the 0.2% annual fee that was applied on your Vanguard Cash Account, Vanguard managed funds, or Vanguard ETFs. However they have kept the fee for any ASX shares that aren’t Vanguard ETFs, reduced to 0.10%. Clearly this is a great change and frankly a fee they should not have had to begin with, still a bit disappointing that they’ve kept a fee for non-Vanguard shares and to be honest, this is probably going to make it tough for anyone to consider using if they are thinking about investing in anything other than Vanguard ETFs

- The brokerage fees have also changed quite a lot. No longer is it free to purchase additional units of Vanguard ETFs and it will now cost you $9 a trade. Any other ASX shares or ETF will also cost $9 a trade, a significant reduction from the prior $19.95 a trade or 0.15% of the trade amount. Brokerage fees for Vanguard managed funds have remained unchanged at no cost.

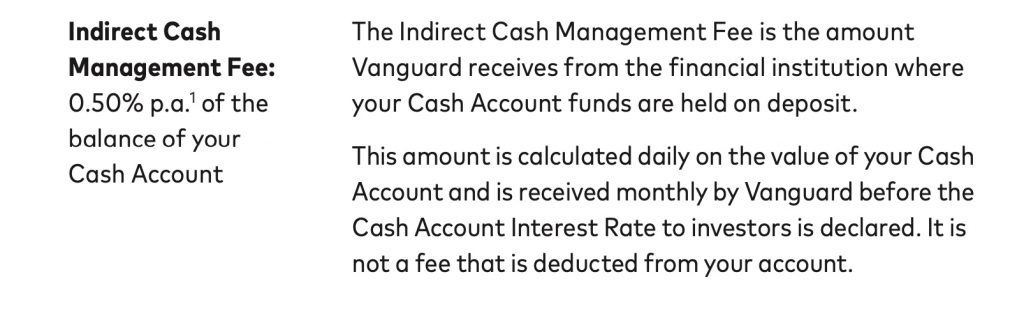

- Interestingly if you dive into their PDS you can actually find another fee element that is changing but isn’t listed on their main pages, and this is their “Indirect Cash Management Fee”. This is essentially a fee that is paid to Vanguard directly from the bank that is providing the Vanguard Cash Account and is not a fee that is deducted from your account. What it does mean is that the interest return that you would normally receive from funds in this cash account will be reduced, and is certainly NOT a “competitive interest return” that Vanguard Australia states on their website. The interest return you actually receive at the time of this post is only 0.35%.

Normally with most stock brokerage type of accounts you would keep very little in the cash account, however with Vanguard Personal Investor they actually deduct the account keeping fees from this cash account, so you’re actually forced to keep a certain amount of cash in this account to cover the fees.

- Lastly the final item that seems to be changing (and again conveniently left off the main page) is the fee cap of $600. Previously all account fees would be capped at $600 a year, however in the new fee structure that detail seems to have been omitted, which means for larger portfolios (greater than $600,000) this is definitely something worth considering for the future.

What’s not changing

- The minimum investment amount of $500 hasn’t changed, which makes it pretty accessible but not quite as low as some competitors.

- The types of investment products you can invest in through the Vanguard Personal Investor product hasn’t changed. Which are Vanguard managed funds, Vanguard Australia ETFs, and a selection of ASX shares. Note here that not every share available on the ASX can be purchased through Vanguard Personal Investor, just the top ASX shares by market capitalisation.

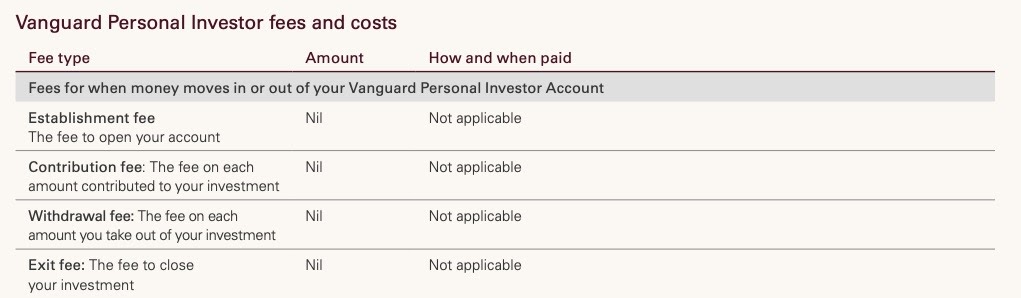

- And in terms of fees for setting up the account there’s nothing that’s changed here as well. With no fees for opening up an account, no fees for transferring funds into the account and no withdrawal or exit fees. Which is great.

How do the changes stack up?

Now, looking at just the changes in isolation – they’re actually pretty good overall, with most fees reducing or completing disappearing. But I think what has resulted is an extremely niche product that is only really “great” for investing in Vanguard managed funds. Let me explain with an example of a mixed fund portfolio and a Vanguard fund only portfolio using the Vanguard Personal Investor Australia product.

Vanguard Personal Investor Australia for a mixed portfolio (Regular ASX shares + Vanguard ETFs)

Say you had a mixed portfolio like below:

Investment of $50,000 in a portfolio comprised of:

- $500 Vanguard Cash Account

- $24,750 Vanguard Australian Shares Index ETF

- $24,750 Direct Shares

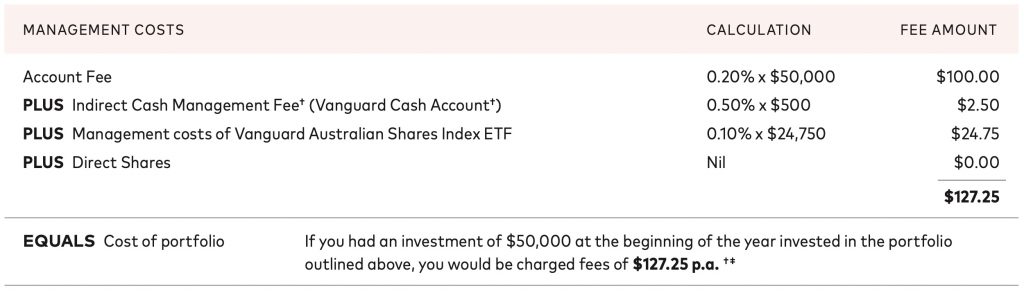

Vanguard Personal Investor – Fee structure effective until 17 August 2021 inclusive

If you had an investment of $50,000 at the beginning of the year invested in the portfolio outlined above, you would be charged fees of $127.25 p.a. Compared with the new fee structure on the same portfolio.

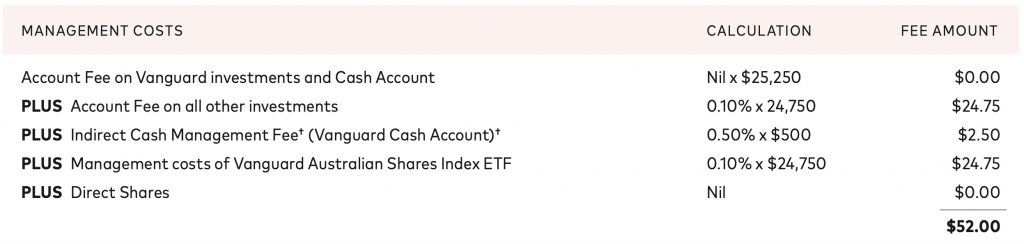

Vanguard Personal Investor – New fee structure effective 18 August 2021 inclusive

If you had an investment of $50,000 at the beginning of the year invested in the portfolio outlined above, you would be charged fees of $52.00 p.a.

Which is great overall, as the fees have reduced by more than half. However, if you compared this to holding shares in a standard Australian stock broker, its still not a great outcome as you wouldn’t be charged a 0.10% account management fee on your “other” investments.

Vanguard Personal Investor Australia for Vanguard ETFs

If you’re just buying Vanguard ETFs the offering is quite attractive, as there are no management fees and the brokerage costs at $9 are very competitive. But it becomes very similar to most other low-cost Australian stock brokers in terms of cost, and you lose the flexibility of investing in the entire ASX, whilst also having to pay additional fees for any non-Vanguard shares.

Vanguard Personal Investor Australia for Vanguard Managed Funds

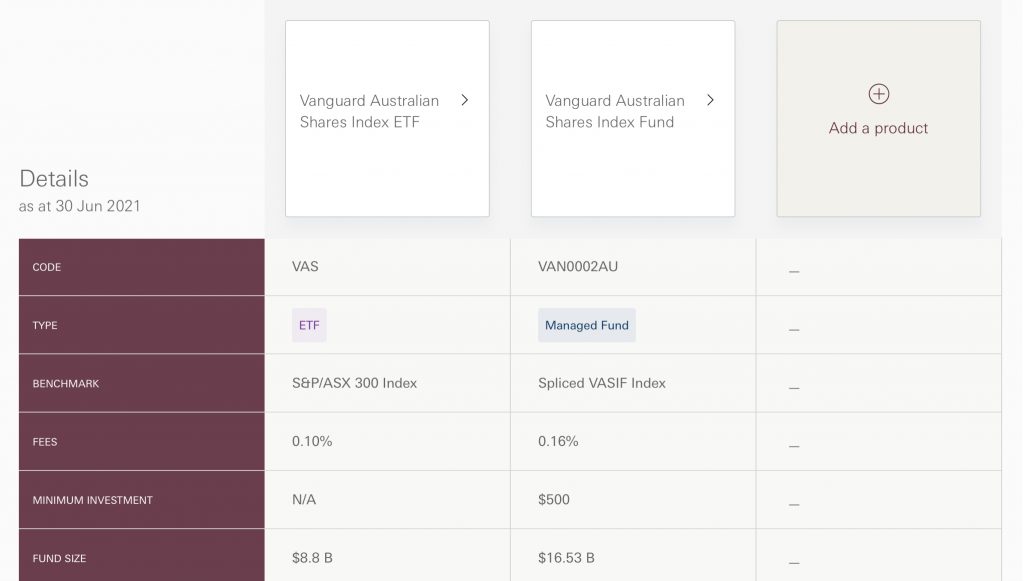

If you’re just looking to invest in the Vanguard Managed Funds then Vanguard Personal Investor is the ideal product, as there are no account keeping fees, and no “brokerage” fees. However the managed funds have higher fees than their equivalent ETFs. If we look at Vanguard Australian Shares for example, the ETF has a management fee of 0.10% p.a, whereas the equivalent wholesale managed fund has a fee of 0.16% p.a. There’s also the added benefit that there is no minimum investment amount (other than the initial $5,000). So if you prefer investing in small parcels of less than $500 (the minimum transaction size for ETFs) then that is one small benefit for the managed funds.

So for investors who would like to make frequent smaller transactions this is probably where the Vanguard Personal Investor product shines, as its very likely the $9 brokerage fees would add up to be more than the 0.06% extra fee you are hit with, for using the managed fund equivalents. Keep in mind that’s just the difference between the Vanguard Australian Shares Fund and the VAS ETF, the difference may be larger or smaller between other equivalent funds and ETFs.

Would I recommend using it?

Vanguard only investors

Basically I would only recommend using the Vanguard Personal Investor Australia product if you are looking to invest solely in Vanguard Managed Funds because you like to make frequent smaller investments, and you don’t have a large portfolio where the added management fee of the Vanguard funds vs. Vanguard ETFs doesn’t have a material impact.

Even if you are someone who likes to invest in just Vanguard ETFs, I have problems with recommending this product, as there are other low-cost Australian stock brokers out there at similar or even lower brokerage costs. However the biggest problem with the Vanguard Personal Investor is that shares are not held in a CHESS sponsored model, which means you don’t have the added security and flexibility of a broker who does use the CHESS system. If you’re looking for a low-cost ASX broker to use in Australia, definitely check out my review on the best ASX brokers.

Pearler

OpenTrader

ThinkMarkets

SelfWealth

Mixed Vanguard + other investors

If you are someone investing in both Vanguard listed products and other shares or ETFs, then I wouldn’t recommend using Vanguard Personal Investor, even after the 2021 fee changes. It still isn’t competitive enough and the extra fees + lack of CHESS holdings means it makes little sense to use vs other Australian stock brokers with comparable or lower brokerage fees.

Summary

In summary the Vanguard Personal Investor Australia product is in a much better place after these fee changes but still only makes financial sense to use for a small set of niche Vanguard only investors.

Personally I don’t use the Vanguard Personal Investor and don’t plan on using it even after these fee changes. This is mainly because the ETF market in Australia has become extremely competitive and there are a lot of lower fee alternatives to many popular Vanguard ETFs, for example A200 (0.07% p.a) vs VAS (0.10% p.a) and DHHF (0.19% p.a) vs VDHG (0.27% p.a). I also mainly hold ETFs from funds other than Vanguard so it wouldn’t make sense for me personally.

So with that said you guys thank you so much for reading I really appreciate it. I post articles on investing, money and personal finance so if you want to stay tuned with that make sure return again. Let me know in the comments what you would like me to cover next.

Please let me know a number so I can invest with vanguard personal.