In this post I’ll share with you 9 simple money hacks that you can use every day to help save money on basically everything. This post won’t be about mental frameworks on how to change the way you think about money like “sleeping on any purchase decision” or “thinking about how many hours a purchase is worth to you”, whilst these can help and is something you probably should be doing, sometimes there’s things you just need to buy, like food, and nothing is really going to change by “sleeping on it”. These money saving tips will help you save anywhere from 5% to 80% on everyday things and increase your overall savings rate.

Whilst it’s probably pretty obvious why saving money is a great thing, I want to show you how making small changes on how much you save can have significant impacts on how early you can retire or how much money you retire with.

Average Savings Rate

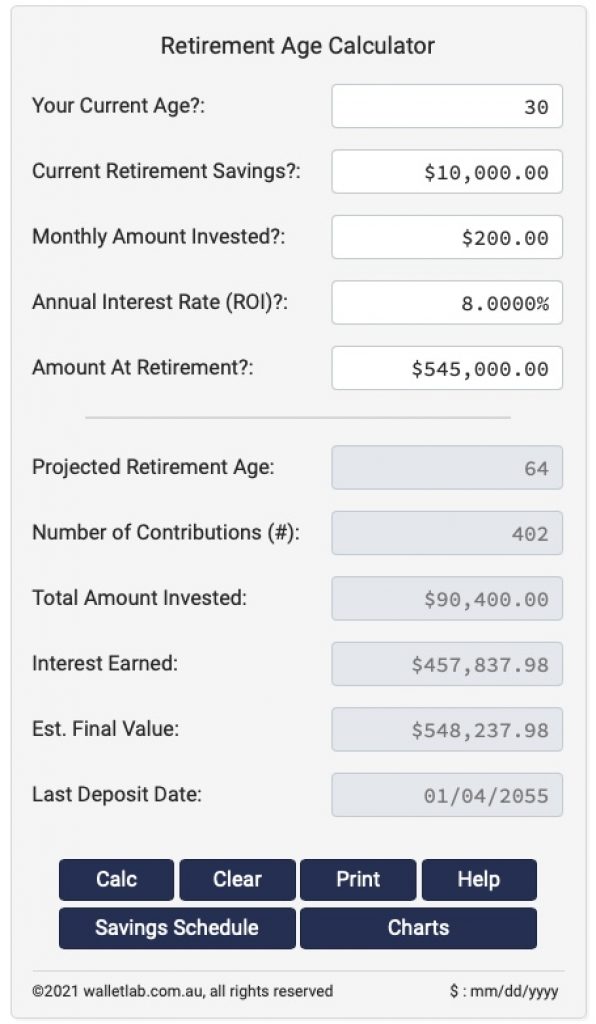

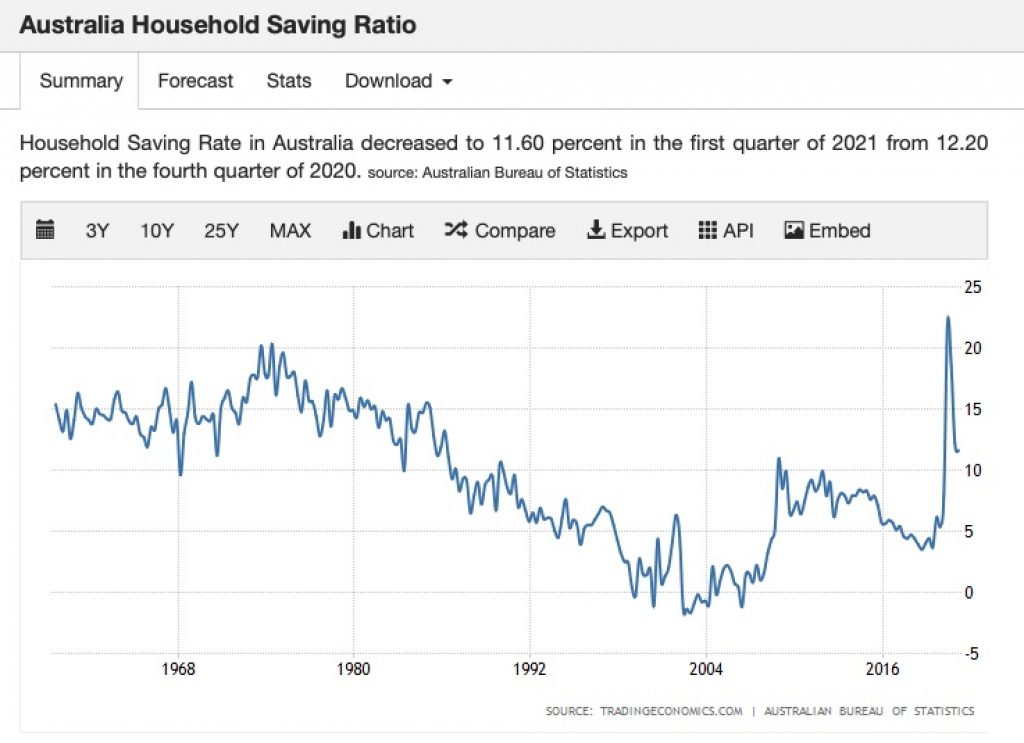

The average savings rate in Australia and the US is around 5%, which based on an average monthly salary of $4,000 would only be $200 a month of savings. And according to the Association of Superannuation Funds of Australia’s Retirement Standard, to have a “comfortable” retirement, you’ll need $545,000.

So if we use this handy retirement age calculator, with some conservative assumptions of being 30 years old, with $10,000 saved, and an investment return of 8% p.a. Through the power of compound interest, we would have the $545,000 required to have a comfortable retirement by the age of 64, which is fine, and probably the time most people would retire.

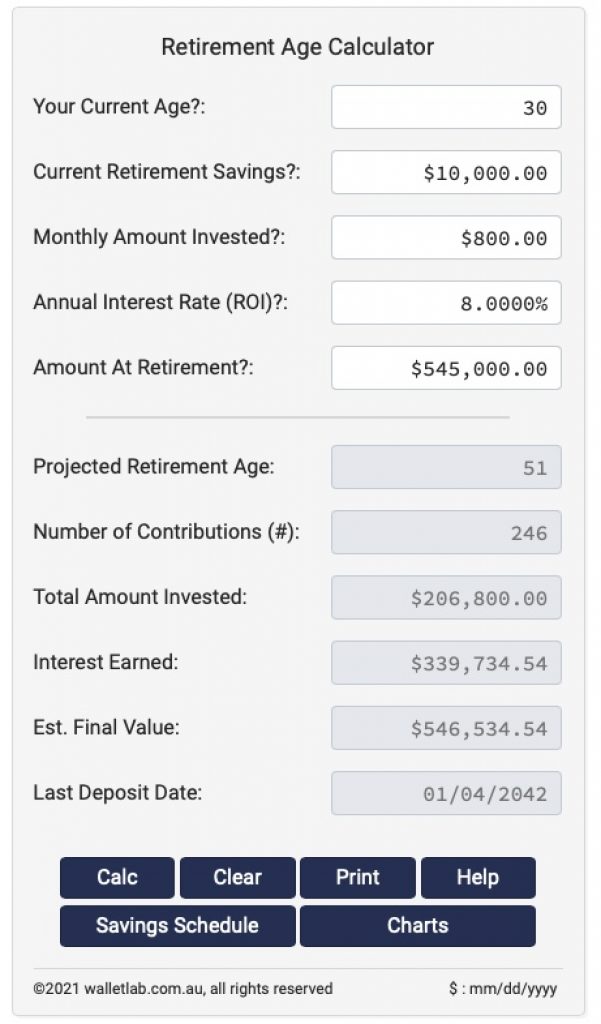

However! Looking at those same savings rate statistics, we know that in times of uncertainty like recessions or even right now during the pandemic, that saving rates are at their highest. In fact, during the peak of the COVID-19 pandemic saving rates hit all time highs of over 20%, as people aren’t sure what’s going to happen and begin to act like hermits, saving money, and hoarding toilet paper.

What this tells us, other than the fact that there is a direct correlation between saving money and the hoarding of toilet paper, is that people are able to save money when they need to, and quite a lot of it. If you instead saved 20% of your income on the average salary, this would be $800 a month. That would mean you would be able to retire at 51, 13 years earlier than if you only saved 5%.

Okay now onto the main topic of this post, where if you follow these money saving hacks I’m sure you’ll be able to reach a savings rate of much higher than 20%. And like I said, these will be practical tips that you can start using to save money straight away, just like you can smash that like button straight away for the youtube algorithm.

1. Never Pay Full Price (unless you have to)

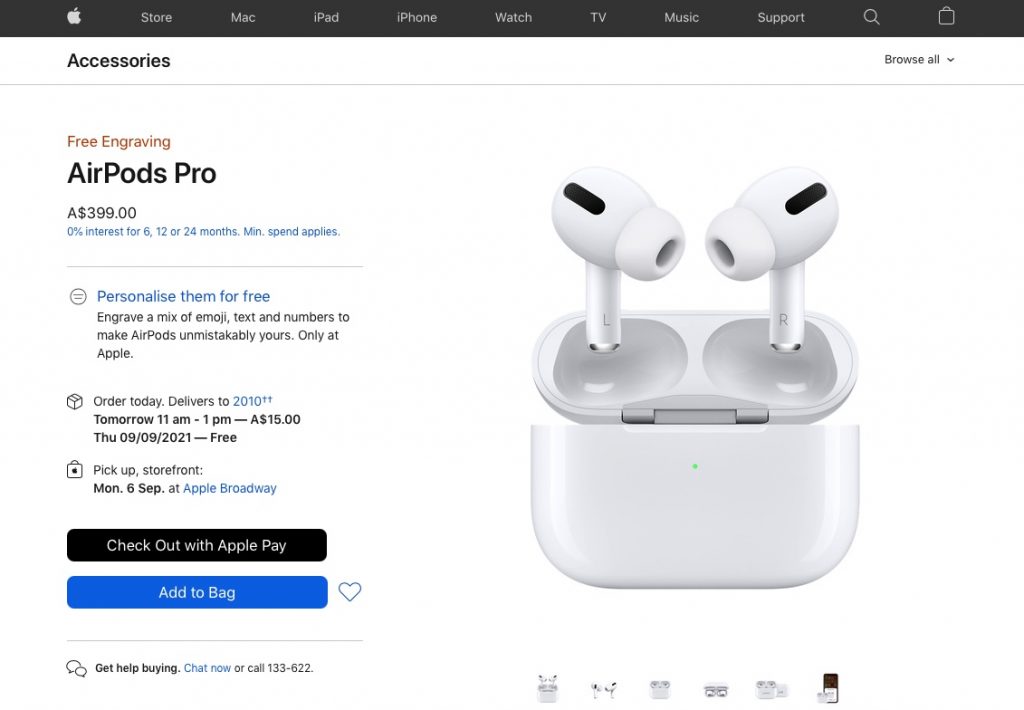

So my first tip is to never pay full price for anything, unless you absolutely have to. And I know this might sound pretty obvious for a lot of you but you would be surprised by the amount of people who see a product they want and just buy it straight away. But let me show you exactly how I do this step by step, and the amount I would save. For this example I’ll pretend that I’m purchasing AirPods Pro, which are currently $399 from Apple directly.

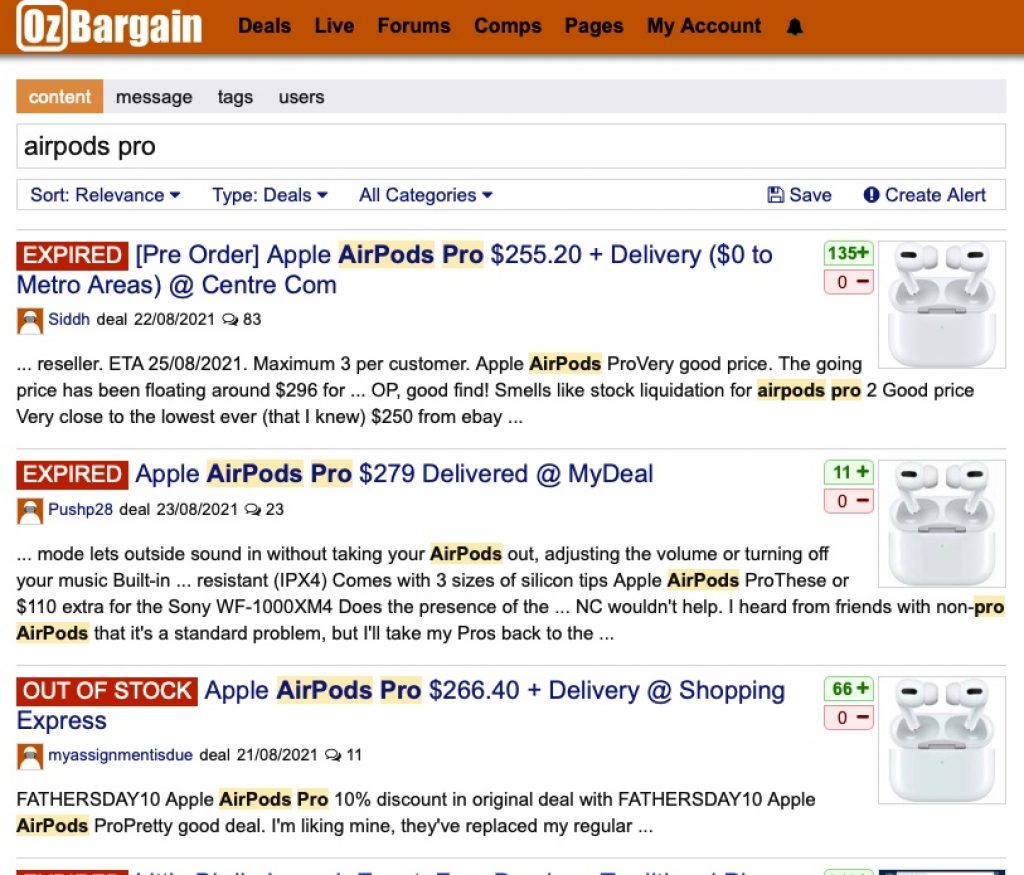

The first thing I would do is search whatever thing I’m looking to get into Ozbargain, this is a community driven website of bargain hunters who refuse to pay full price for anything. This is to get an idea of what I should be looking to pay for an item and to see if there’s currently any promotions on the item.

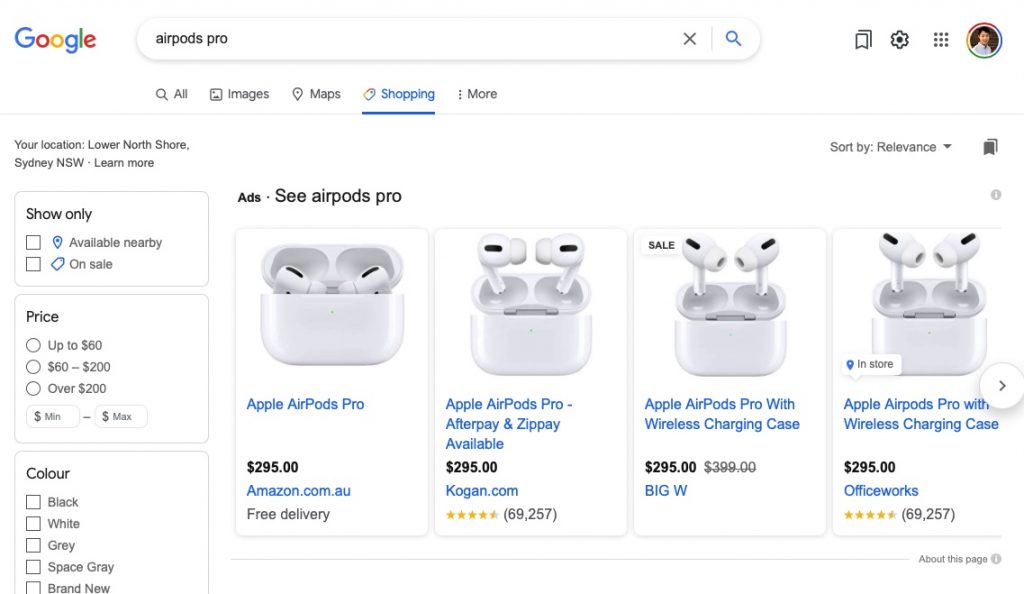

Already I can see that if I paid $399 I would be overpaying by a lot, since most of the deal prices are around $250-$300 but unfortunately it seems that most deals have expired. In this case, the next thing I would do is search this same item on Google Shopping, which is basically a really quick way to find live prices for products from a large range of shops.

Through this search we can see that the lowest price seems to be $295 at the moment which is still pretty good. But we’re not done there.

2. Use Cashback Websites

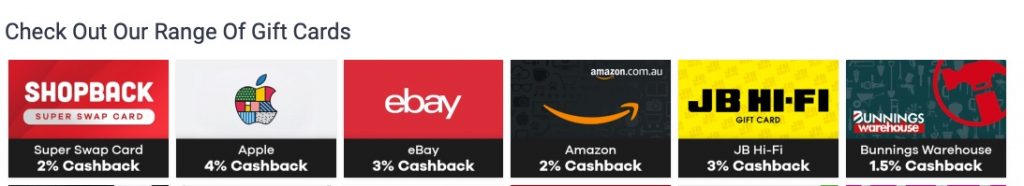

Which brings us to the next money saving hack, which is to use a Cashback website, like Cashrewards or Shopback. What these websites allow you to do – by simply clicking through a special link on their website and making a purchase you can receive varying levels of cashback.

For example with Amazon, the cashback percentage is up to 8% but make sure you check the categories percentages, as we can see that for electronics, we actually get 0% cashback. So for the Airpods we wouldn’t actually get any cashback from Amazon but if we were getting Shoes we’d get 8% back. I always check whichever of the two have a better cash back percentage for the shop I want to use at the time.

Cashrewards: Free $10 when signing up using this link

Shopback: Free $10 when signing up using this link

3. Discounted Gift Cards

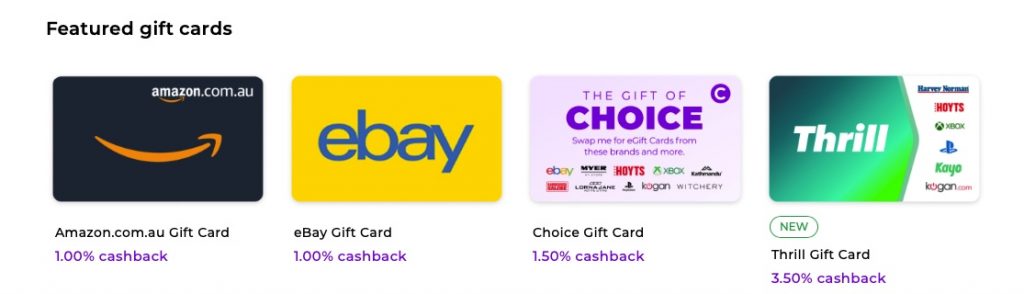

But we still aren’t done yet and can still save some extra money with this next money hack. Which is to always use discounted gift cards whenever you can. Again by going to the gift card section on Cashrewards, we can see that there are Amazon gift cards at 1% cashback but these can vary a lot like Myer at 2% and Harvey Norman at 3% for example.

Whilst these aren’t huge amounts, this can still add up to a lot of savings over time, especially when purchasing higher value items. But remember, always check multiple sources, as whilst Cashrewards only has a 1% discount on Amazon gift cards, Shopback actually has a 2% discount at the time of me writing this.

So with an additional 2% saving, this would bring our Airpods Pro price down to $289.10. Just remember to check if the fine print on the cash back site, as paying with gift cards can make you ineligible on some shops.

4. Reward Credit Cards

There’s actually one last thing we can do with everyday purchases to squeeze out a bit of extra value, and that’s by simply using a credit card that has a rewards program to do the purchase, or in this case the discounted gift card purchase. This one isn’t for everybody but if you’re comfortable with credit cards and paying off the full balance every month, the average return for most reward credit cards is around 1% of spend. As you can use the credit card points on things like gift cards, frequent flyer points, or random items. I personally do all of my spending through a credit card to maximise the value I get out of all purchases. Let me know in the comments if you’d be interested in an article where I go over some of the best credit cards available.

So assuming we will eventually get around 1% of the spend back in value from the credit card reward points, this would bring the effective price of the airpods pro down to $286.21. Saving us almost 30% off the original price of $399 for about 5 mins of extra work.

If you apply those steps to all of your purchases you can really start to make some significant savings.

5. Save on Electricity & Gas Bills

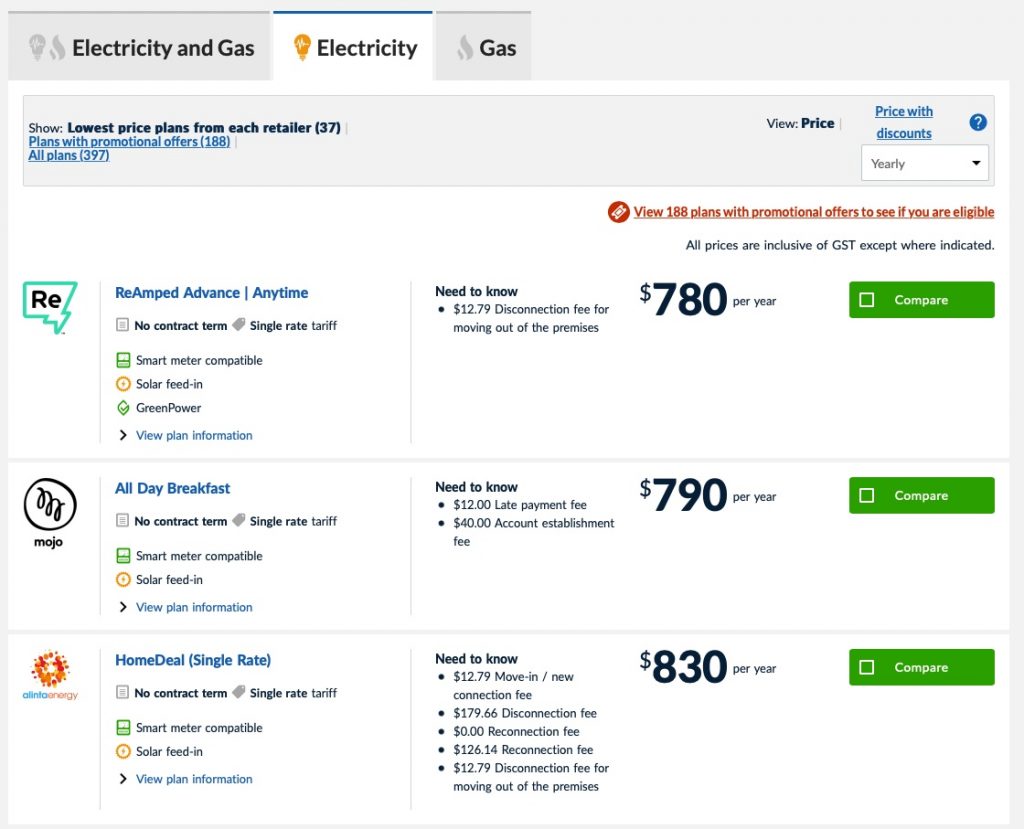

This next hack is to really easily save money on your electricity and gas bills by using the Energy Made Easy comparison site, which was created by the Australian government. Here you can literally upload your current electric and gas bill, and they will tell you the cheapest provider available for you. I personally saved over 20% on my electricity and gas using this, and still check it once every few months to see if it’s still competitive.

This only takes 5 minutes and can save you hundreds.

6. Save Money on Fuel

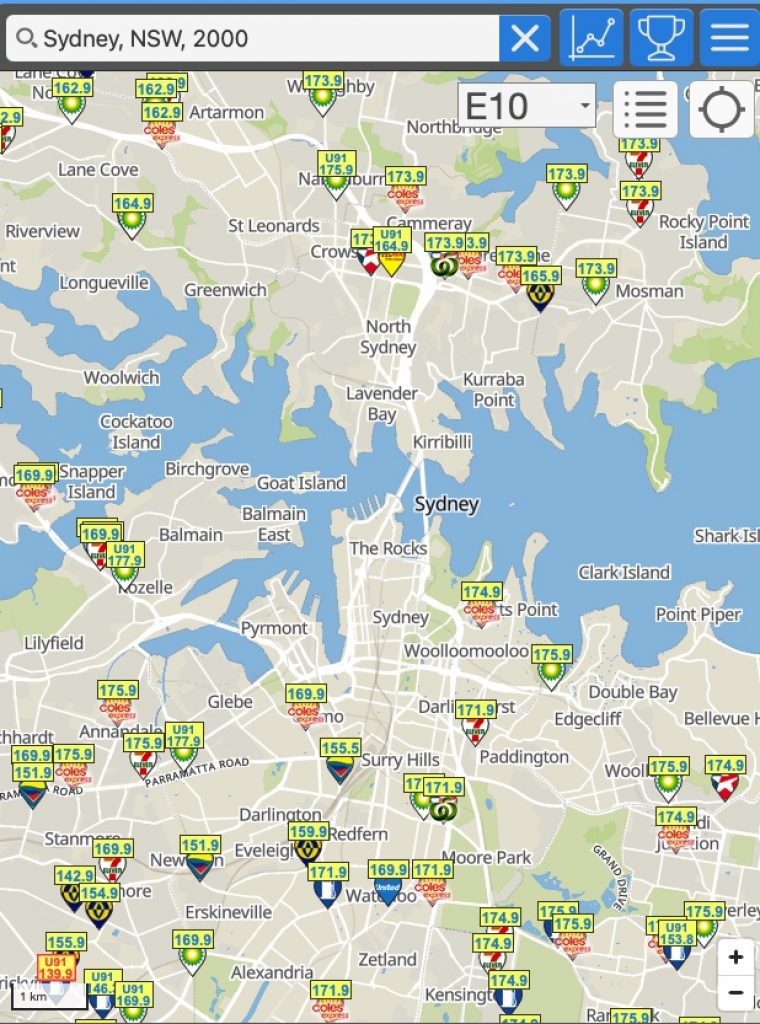

This next money tip is for those of you who drive a car or bike, and is actually another government initiative. Basically, there are huge variances in fuel prices and the NSW government has created a FuelCheck app to see where the cheapest pump is. If you aren’t in NSW there’s also a non-government site that covers all of Australia called PetrolSpy where you can do the same thing. At the time of writing this post the cheapest E10 in Sydney was 134.9c/L whereas the most expensive 175.9c/L. Huge savings to be made here, and often you don’t need to drive very far to find a significantly cheaper station.

7. Save on Flights & Travel With Google Flights

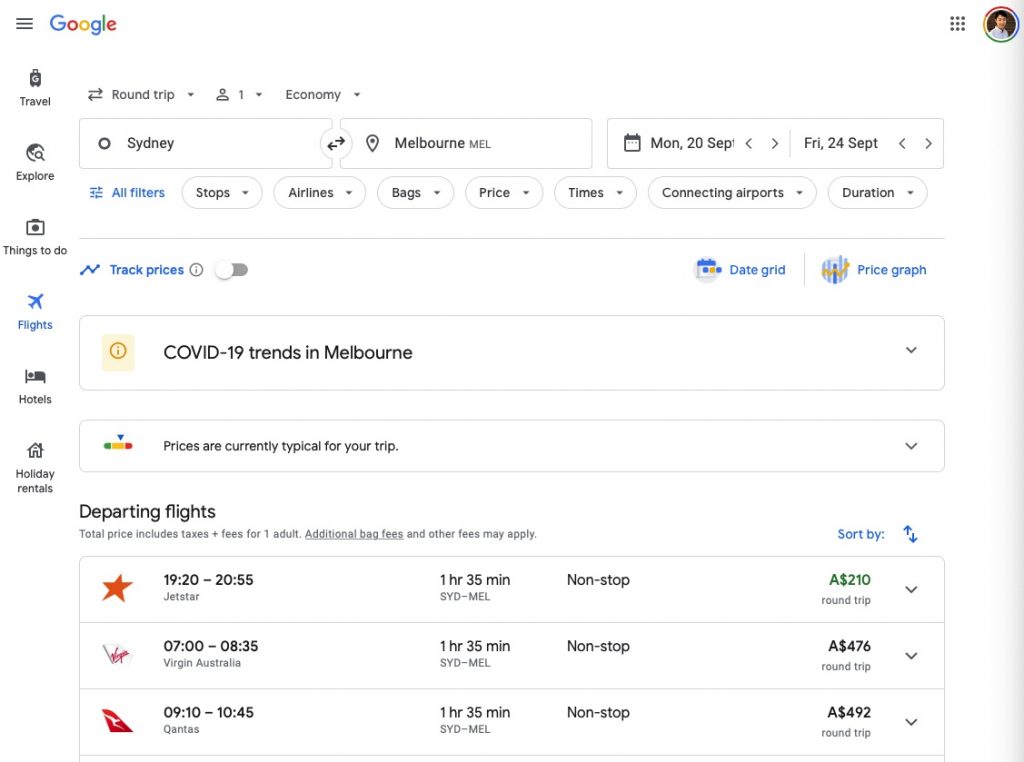

Travelling and flying isn’t really possible at the moment due to COVID lockdowns. However at some point we’ll be able to fly again (and hopefully by the time you’re reading this we’re already back to normal). And there is actually a really easy way to ensure you aren’t getting ripped off when booking flights.

All you need to do is go to Google flights, search your locations and dates, and they’ll compare all the different options for you and show you the cheapest rates.

8. Minimise Brokerage Costs When Investing

Now that you’re saving all of this money, you should make sure that you aren’t spending more than you need to when you’re investing it. The best way to do this is by using a stock broker with low brokerage fees, I’d say if you’re paying anything more than $10 a trade it’s too much and there are better alternatives out there. Check out my post on the best low cost ASX brokers in Australia where I cover them in detail.

This is a really simple way to save a few hundred dollars a year as it’s extremely easy to transfer shares between brokers in Australia, and given that the service is a commodity it makes sense to minimise your costs here.

9. Negotiate Everything

This last money hack requires a bit more effort than the others but is a good skill to learn and utilise, and that’s to negotiate on basically everything. Most people don’t realise that you can often get a better price or rate on most products simply by asking, and whilst this might be a bit embarrassing or intimidating to do at first, once you get used to doing it, it becomes second nature and the worst that can happen is they say no.

For example I won’t buy anything from JB Hi Fi in-store without asking for a discount on the sticker price and I’ve saved anywhere from a few dollars to hundreds of dollars on items. I’ve saved money on my phone bills, internet bills and insurance, simply by calling up and asking for a discount or saying I’m thinking about leaving to another provider. You’d be surprised by what you can save just by asking!

Lastly, one more thing I want to mention because this part is absolutely vital to anyone who wants to increase their savings. The harsh reality is that if you’re already doing all of the above and you’re still not saving enough money there’s no way around it you need to make more money. That is the truth and when I say something like this I don’t mean for it to sound like THAT person who says “oh why don’t you just make more money”, because I get how it sounds and it’s not as if you’re not already trying to make more money. But when it comes to doing this at a certain point there’s really only so much that you can save through various hacks before it starts compromising your quality of life. Everyone will get to a point eventually where you cannot possibly save any more money and it’s at that point that you should begin to shift your efforts from saving money to learning how to make more money.

You only have so many hours in the day so if you can find a way to make more out of each of these hours, or produce income that is decoupled from your time directly, that would be ideal. I truly believe that if you try out some of the money saving hacks and look to increase your income where possible, you’ll be able to significantly increase your saving rate and retire much earlier.