Intro

For those of you aren’t familiar with The Barefoot Investor, well it’s one of the most popular personal finance books in Australia, in fact it’s currently #1 best selling book in personal finance. And in this post we’re going to dive into the various Index Fund portfolios that the Barefoot Investor has constructed and recommended over the years.

Who is The Barefoot Investor?

The Barefoot Investor is now one of Australia’s most trusted finance experts, frequently speaking on national TV to provide advice to everyday Australians.

In a nutshell The Barefoot Investor is a no-BS guide to taking control of your personal finances with very simple and practical steps that all Australians can follow. Here is a link if you want to check it out for yourself. One of the main lessons that Scott shared in the book was to: Automate your retirement planning by investing in Index Funds.

And in regards to investing, he used to actually run a paid newsletter called the Barefoot Blueprint, where he shared a lot of stock and ETF recommendations, he even shared some Index Fund portfolios that we’ll discuss today.

What are Index Funds?

But just quickly before we go into the Barefoot Investor Index Funds, an index fund is just a simple way to invest in a large collection of stocks. An index fund might have thousands of different individual stocks in it but you only have to make one purchase to own a portion of all of them. In a world without index funds, if you wanted to have say a thousand different stocks in your portfolio you’d have to make 1000 separate purchases. If you’re paying $10 per trade that would cost you $10,000 alone just buying the companies, on top of also taking you a lot of time!

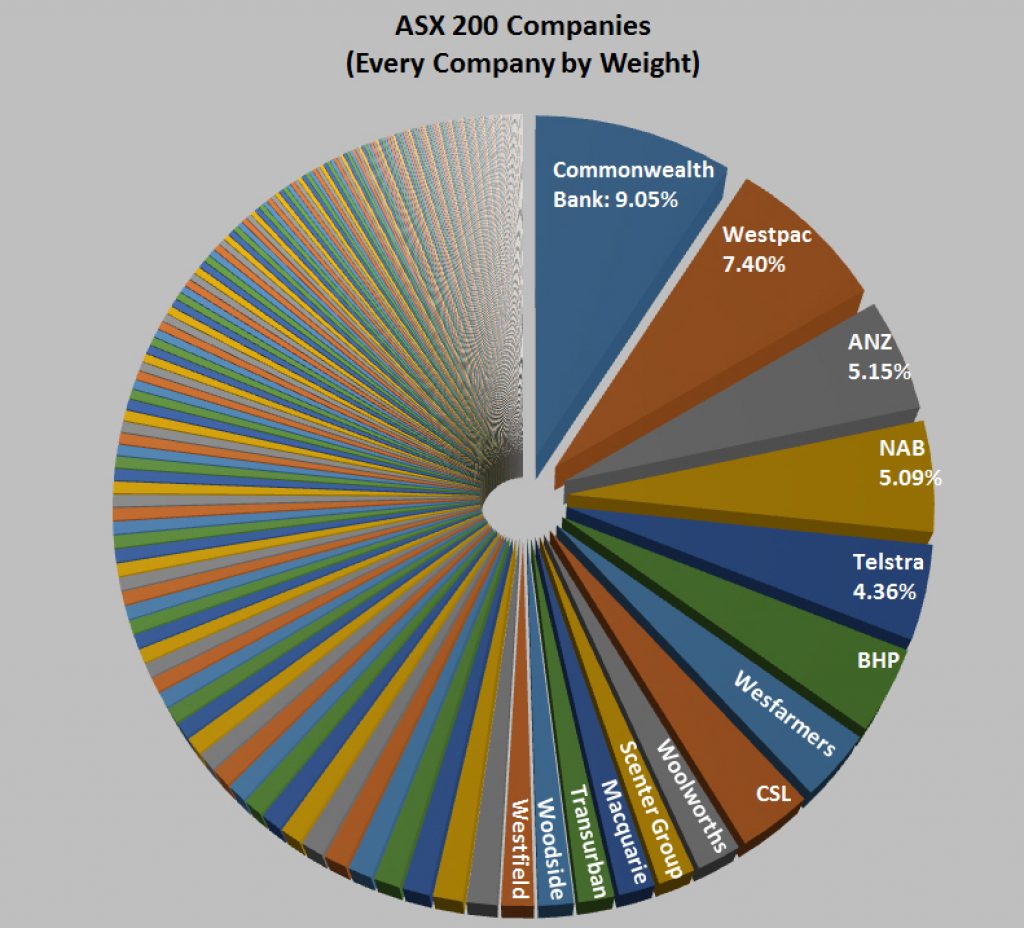

Using an index fund is way simpler than trying to self-manage a portfolio of thousands of different companies, constantly trying to re-balance weightings every day. And the best feature of an index fund is in its name, it’s the fact that it passively tracks an index. An index is a set of “investment instructions” that the fund needs to abide by, for example an index fund that tracks the ASX200 is tracking the performance of the 200 largest companies listed in Australia on the ASX.

Through owning a lot of different stocks this gives you the other major benefit of these index funds, that is diversification. If you have 5 individual stocks in your stock portfolio and one of those goes down and fails, you can end up losing a lot of money. On the other hand if you go and buy the entire ASX200 index fund, then you have 200 different stocks and companies that contribute to your overall return. So even if one of those fails it doesn’t really matter because you have 199 others to boost you up.

The Barefoot Investor on Index Funds (what Scott Pape REALLY thinks)

Now onto the Barefoot Investor Scott Pape and what he really thinks about Index Funds, well the best way to describe this would be, confusing. I don’t say this lightly and I’ll explain what I mean.

On one hand it’s clear that the Barefoot Investor is a fan of passive index funds and the benefits that they bring, as he brings them up in several sections of the book. On page 141 of The Barefoot Investor it reads:

“Respected US financial research firm Dalbar has been tracking investors’ real returns for decades. And here’s the shocker: their research shows that the average investor earned 3.7 percent annually over the past 30 years, during a period in which a basic index fund returned 11.1 percent annually. In other words, the average investor underperformed the market by approximately 7.4 percent each year for 3 decades.”

Even echoing Warren Buffet’s praise of the Index Fund a few pages earlier.

“Warren Buffett, the world’s greatest investor, is leaving his wife her entire inheritance in a simple index fund that automatically buys the 500 largest companies in America. We’re talking about companies like Apple, Google, Facebook, McDonald’s, Amazon, and Nike. My super does the same thing, but it’s also got the 200 biggest Aussie companies – like banks, Telstra and BHP.”

Even the superannuation fund that Pape recommends, the Indexed Balance Fund from HostPlus, is an Index Fund superannuation option! From these sections in the book (among many others), it’s clear The Barefoot Investor understands that for the everyday Australian, low cost, passively managed index funds are the optimal way to invest. However when it comes to his section in the book about investing outside of your superannuation, the Barefoot Investor doesn’t recommend a passive index fund. Instead his recommendation is an actively managed LIC on the ASX, which stands for Listed Investment Company. A quote from The Barefoot Investor:

“…my recommendation for your first investment would be the Australian Foundation Investment Company (AFIC).”

What really confused me even further, was that until just recently, The Barefoot Investor used to run a newsletter (that I mentioned earlier) called the Barefoot Blueprint, which had an annual fee of a few hundred dollars. And in the Barefoot Blueprint he would share individual stock tips recommendations to his followers. Which we just established would significantly underperform an index, based on the quote from The Barefoot Investor that I shared earlier.

Thankfully in 2019 he did shut down the Barefoot Blueprint newsletter and before he did he did share some Index Fund Portfolio strategies which is what we’ll get into now.

The Barefoot Investor Index Fund Portfolio #1 – The Breakfree Portfolio

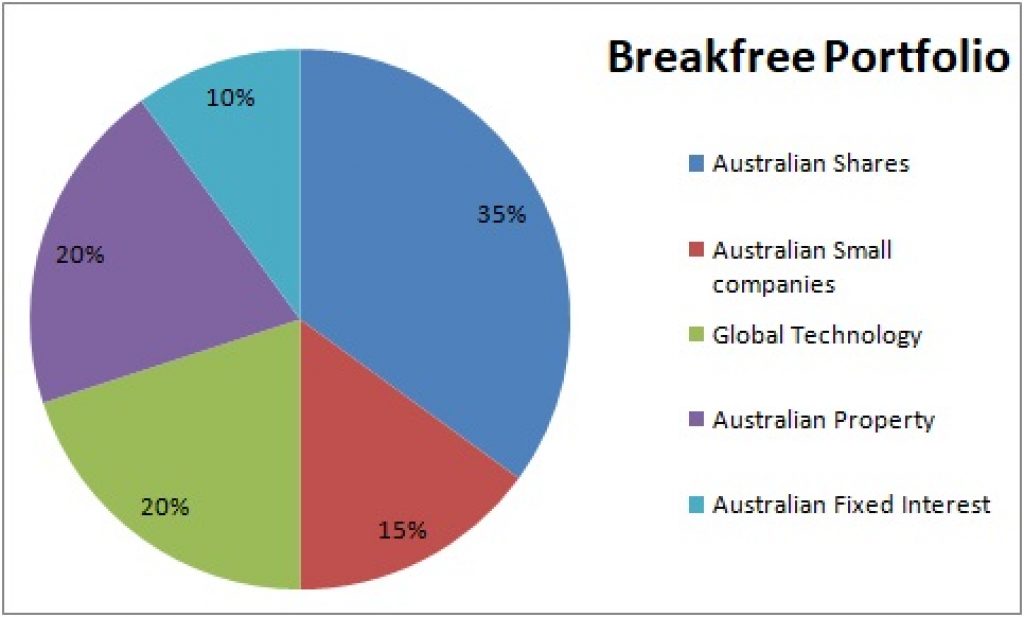

The original Barefoot Investor Index Fund Portfolio that he shared in his private newsletter was called the “Breakfree Portfolio”, with the premise of it being easy to manage. It consisted of 5 ETFs which he suggested to re-balance once a year to keep to the recommended percentage allocations. Each ETF was in a specific sector, being:

- Australian Large-caps: STW – 35%

- Australian Small-caps: VSO – 15%

- Global Large-caps: IOO – 20%

- Australian Property: VAP – 20%

- Australian Fixed Interest: VAF – 10%

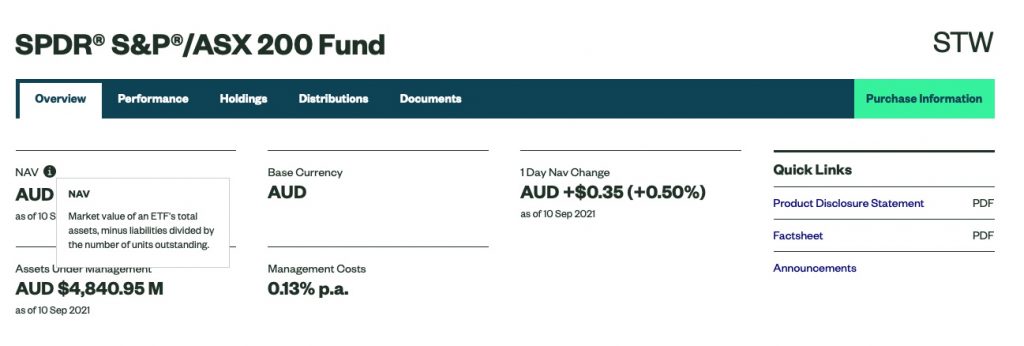

Australian Large-caps: STW – 35%

The STW ETF is run by State Street and tracks the ASX200 Index. Its objective is to capture potential stock growth opportunities, dividends and franking credits offered by 200 largest, and most liquid, publicly listed entities in the Australian equity market. It has a management fee of 0.13% and has returned over 8% p.a since inception over 20 years ago.

The Barefoot Investor recommends having an allocation of 35% in STW as he tends to prefer Australian equity allocations, with large-caps from the ASX 200 being the most stable with a decent dividend yield.

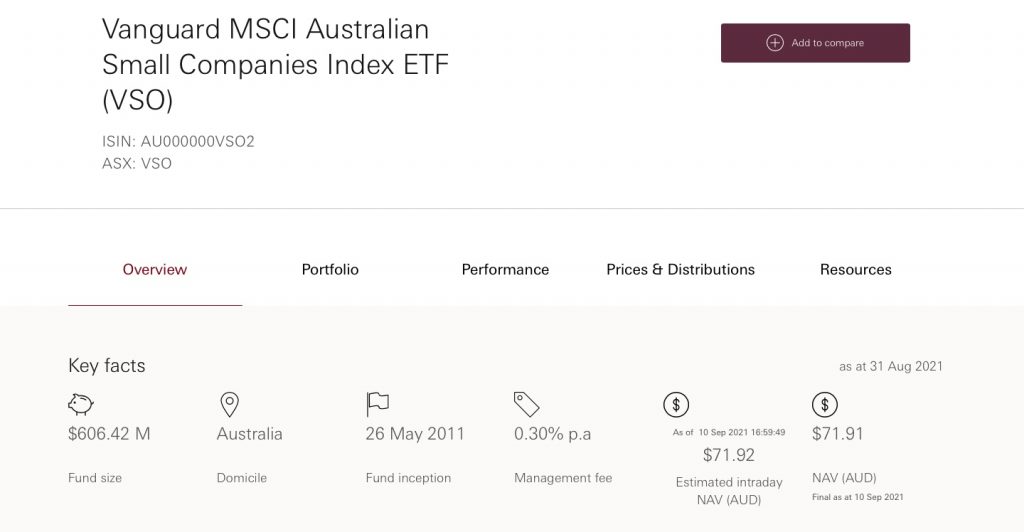

Australian Small-caps: VSO – 15%

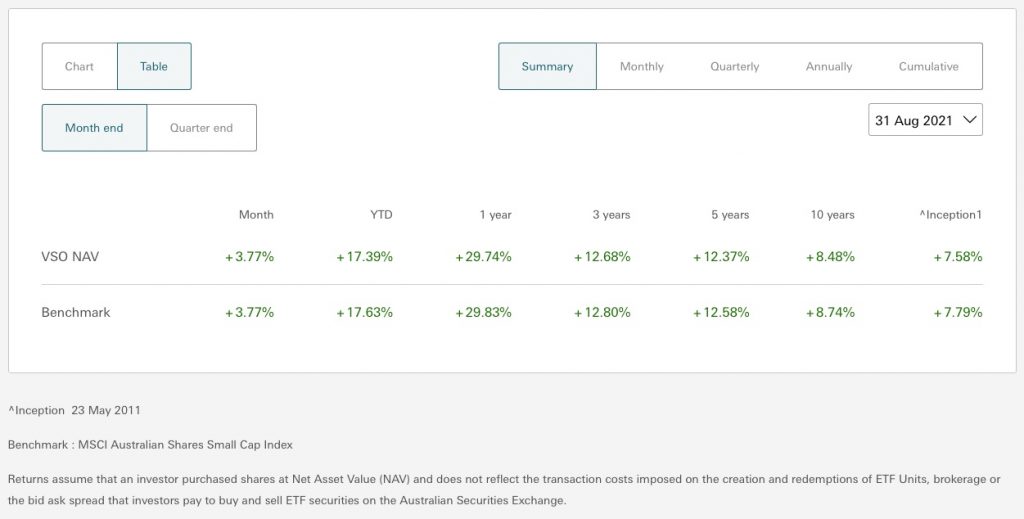

The next ETF The Barefoot Investor recommends as part of this portfolio is VSO which is run by Vanguard and tracks the MSCI Australian Shares Small Cap Index. Its objective is to provide diversified exposure to small companies listed on the ASX. It has a management fee of 0.30% p.a and since inception in 2011 has returned 7.58% p.a.

The Barefoot Investor recommends having an allocation of 15% in VSO in order to diversify your concentrated Australian equity holdings, which is probably the right move but at this point with over 50% in just the ASX, feels a bit too concentrated.

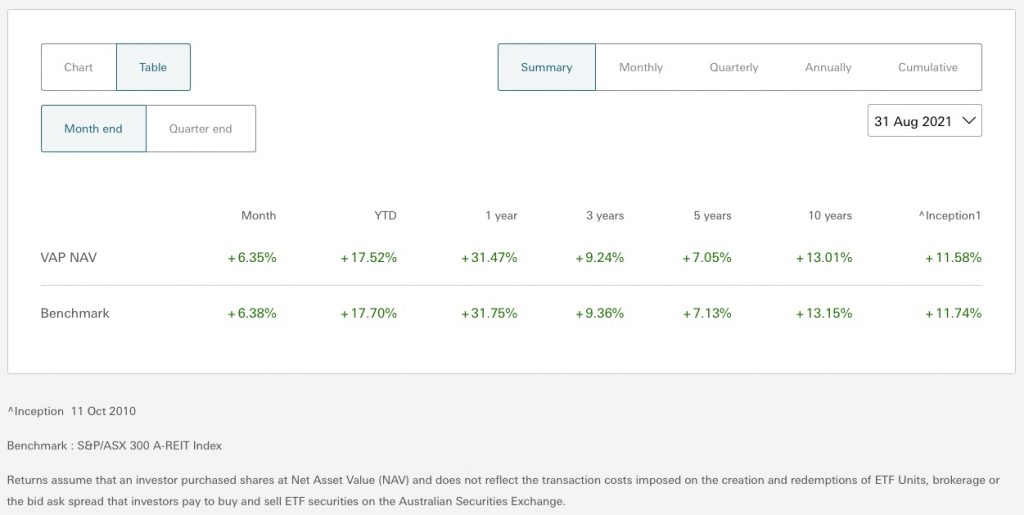

Australian Property: VAP – 20%

Continuing with the Australian theme, the next ETF the Barefoot Investor recommends for this Index Fund Portfolio is VAP, another Vanguard ETF which tracks the S&P/ASX 300 A-REIT Index. Its objective is to invest in property securities on the ASX to provide exposure to both residential and commercial real estate performance. It has a management fee of 0.23% p.a and has returned over 11% p.a since inception in 2010.

The Barefoot Investor recommends having an allocation of 20% in VAP, in order to get exposure to the Australian property sector, at this point we have over 70% of our portfolio in Australia.

Global Large-caps: IOO – 20%

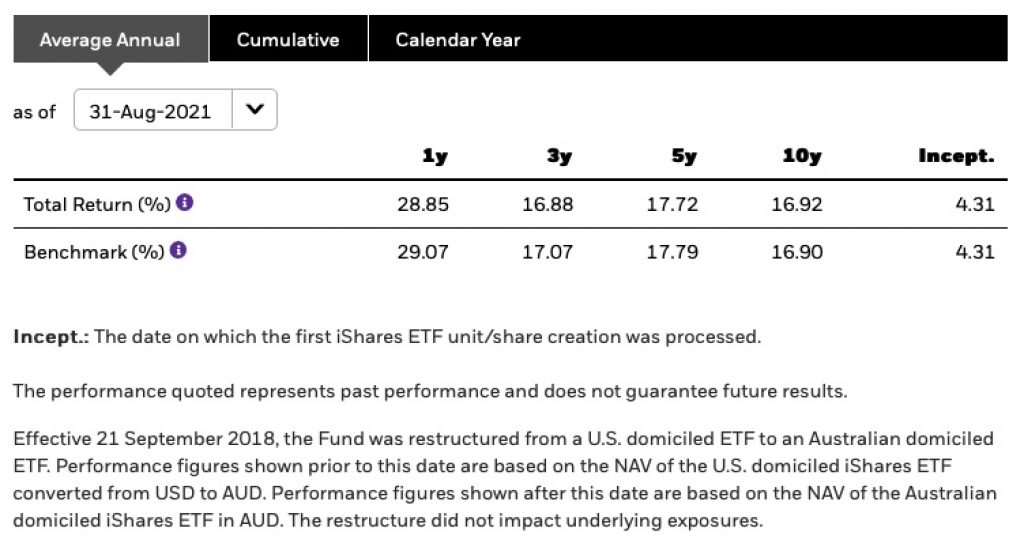

In the first ETF with exposure outside of the ASX, The Breakfree Index Fund Portfolio recommends a 20% exposure to IOO from Blackrock. The fund aims to provide investors with the performance of the S&P Global 100TM Index, before fees and expenses. The index is designed to measure the performance of 100 multi-national, blue chip companies of major importance in global equity markets. IOO has a management fee of 0.40% p.a and since inception in 2018 has returned 4.31% p.a. However the index it is tracking has been around much longer and over the past 10 years has returned over 16% p.a.

The Barefoot Investor recommends a 20% allocation of this Index Fund portfolio into global large cap companies and is frankly a much needed change to the over-exposure into Australia.

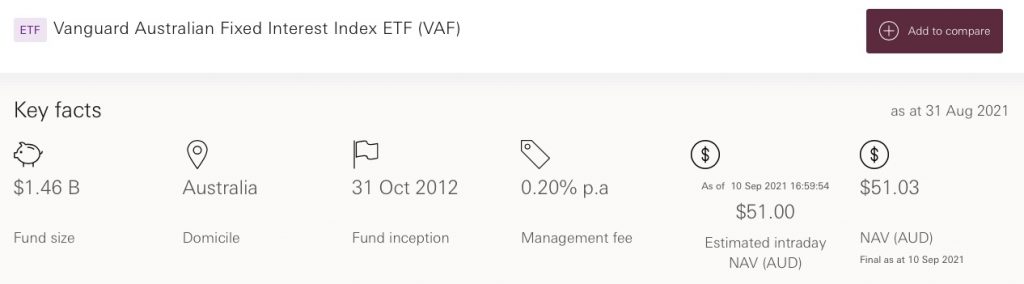

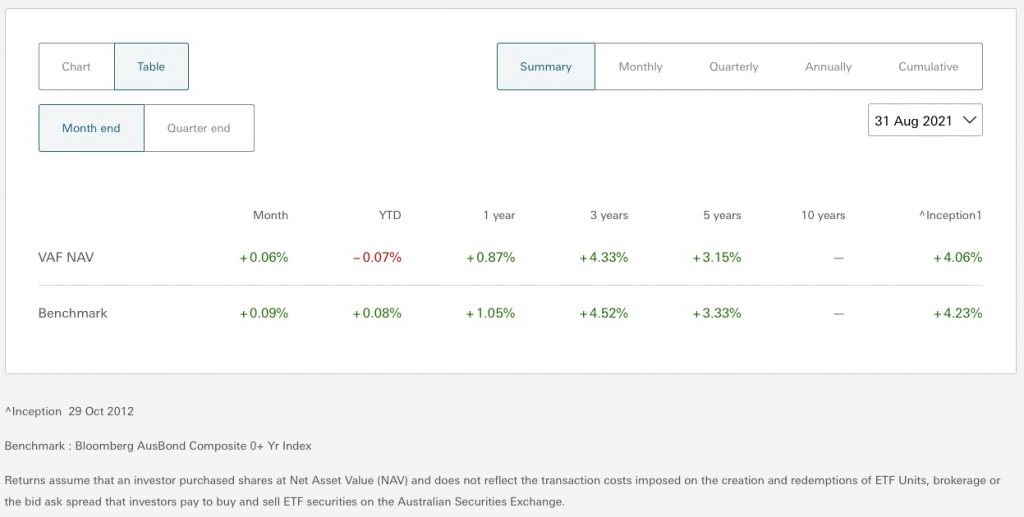

Australian Fixed Interest: VAF – 10%

Finally to cap off the Breakfree Index Fund Portfolio, Pape recommends a 10% allocation into the VAF ETF from Vanguard, which tracks the performance of high quality Australian bonds. VAF has a management fee of 0.20% p.a and since inception in 2012 has returned over 4% p.a.

Given the broad demographic of the Barefoot Investor readers, it makes sense to have an allocation into fixed interest bonds to reduce the overall volatility of the portfolio.

The Breakfree Portfolio Summary

Overall the Breakfree Index Fund Portfolio is certainly not a bad portfolio but personally I think it’s way too concentrated in its Australian exposure. In addition the overall management fees are actually pretty high and the recommended ETFs could definitely be simplified and swapped out for lower cost alternatives, which I’ll go into shortly.

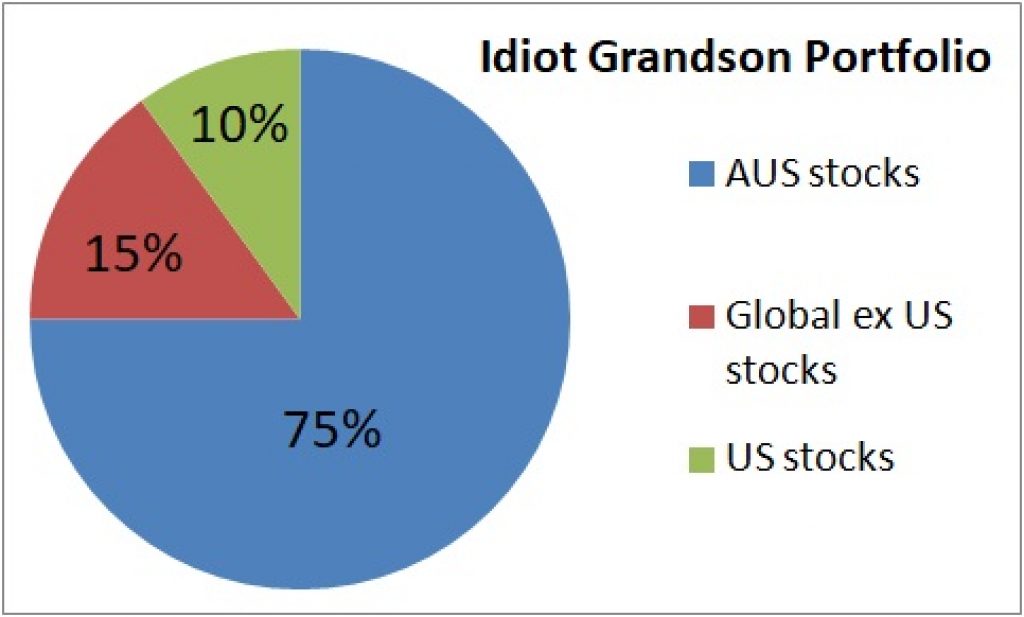

The Barefoot Investor Index Fund Portfolio #2 – The Idiot Grandson Portfolio

But before we do, we should look at the second Index Fund Portfolio from The Barefoot Investor, which he put together before shutting down his Barefoot Blueprint community, this was named “The Idiot Grandson Portfolio”. The asset allocation strategy used a combination of ETFs that invest in Australian, International, and U.S. shares. The aim of the Idiot Grandson Portfolio was to be a permanent set-and-forget investment portfolio that would provide a steady stream of income in the form of dividends that could be passed down through the generations.

The Barefoot Investor analysed 201 ETFs and 114 LICs listed on the ASX to find the best investments to add to this Index Fund portfolio. The Barefoot Investor used a three stage filtering process to reduce the 315 funds down to just 10 Index Funds for the Idiot Grandson Portfolio.

The Filtering Process: First Cut (Remove High Fees)

The first cut that The Barefoot Investor used here was pretty straightforward and involved removing any funds that had a management fee of over 0.40% p.a. This quickly reduced the amount of LICs down from 114 to 10 and the number of ETFs from 201 to 60.

The Filtering Process: Second Cut (Remove Undesirables)

The second filter that the Barefoot Investor used to reduce the fund count was to remove any funds that were “undesirable”. This was very subjective and the definition of “undesirable” was any funds that were:

- Small-cap Funds: any funds that were focussed on purely small-caps, due to their higher than average volatility were removed.

- Outliers: funds that specialised in specific areas or strategies were removed, as they weren’t broad in nature. This included things like high-yield dividend harvester type funds, which actually don’t have great total-returns over the long run.

- Synthetic: any funds that involved using derivatives or were synthetic in nature were removed, this included any internally leveraged funds as well.

- Equal-weight Funds: all equal-weight index funds were removed, as they don’t track a market as closely as a market-weighted fund.

- Industrial Funds: and finally any industrial funds were removed, as they generally aren’t tracking a broad diversified index.

After this second cut, the Barefoot Investor Index Fund Portfolio was left with just 13 ETFs and 6 LICs.

The Filtering Process: Third Cut (Management Style)

The third and final filtering process was even more subjective than the second one and involved looking at the management styles of the various remaining funds. The Barefoot Investor chose to focus on funds that were purely not for profit.

This left the Idiot Grandson Portfolio with just 10 funds remaining.

The Barefoot Investor Index Fund Portfolio: The Idiot Grandson Portfolio

Australian Funds:

- AFI: Australian Foundation Investment Company (LIC)

- ARG: Argo Investments (LIC)

- AUI: Australian United Investment Company (LIC)

- DUI: Diversified United Investment Company (LIC)

- MLT: Milton Corporation (LIC)

- VAS: Vanguard Australian Share Fund (ETF)

US Funds:

- VTS: Vanguard US Total Market Shares Index (ETF)

Global Funds:

- VEU: Vanguard All-World ex-US Shares Index (ETF)

- VGAD: Vanguard MSCI Index International Shares (Hedged) (ETF)

- VGS: Vanguard MSCI Index International Shares (ETF)

The allocations The Barefoot Investor recommends is 75% Australian Stocks, 15% Global Stocks excluding the US, and 10% US Stocks. In my opinion this is way too concentrated in Australian stocks. However if you wanted to follow the Barefoot Investor Index Fund Portfolio guide, the lowest cost selections (and simplest), would be:

- VAS: Vanguard Australian Share Fund (ETF): 75%

- VEU: Vanguard All-World ex. US Shares Index (ETF): 15%

- VTS: Vanguard US Total Market Shares Index (ETF) 10%

Improved (and simplified) version of The Barefoot Investor Index Fund Portfolio

But there’s a much simpler and optimal way of constructing the Barefoot Investor Index Fund Portfolio, by using just 2 ETFs. This is through the BetaShares A200 ETF at 25% allocation and the Vanguard International Shares Fund VGS at 75% allocation. This is comprised of 75% International and 25% Australian exposure, giving you decent diversification to Australian companies and their sweet franking credits, as well as exposure to the rest of the world, and there’s no overlap as VGS doesn’t include Australian holdings.

Be sure to check out my full post on the two fund portfolio where I cover, why this makes sense and what the benefits are.

And there’s actually a really simple way to automate this entire process and put your investing on autopilot. That’s by using Pearler which is an investing platform available in Australia that has this really unique Autoinvest feature, that allows you to configure predefined investment instructions to automate your investing, much like how an ETF has to follow an index’s investment instructions. So you can basically tell it to invest in A200 25% and VGS 75%, set up your deposit schedule, and it will take care of the rest.

If you want to check out Pearler, sign up using my link where you’ll get a brokerage FREE trade for signing up. In addition, check out my comprehensive review on Pearler if you want to learn more about Pearler and it’s features before diving in. Finally here is a link to my public profile on Pearler, where you can follow me and my investments.

Summary

My final thoughts on the Barefoot Investor Index Fund Portfolios is that they have way too much exposure to Australia and are slightly more complicated than necessary. I prefer to keep it simple and as low-cost as possible.

[url=http://tadalafi.online/]buy cialis nz[/url]

[url=http://ifinasteride.com/]cheapest generic propecia[/url]