In this post we’re going to look at the most recommended ETF in the financial independence community VDHG from Vanguard and compare it with the rising competitor DHHF from BetaShares, to settle the debate of which one is the ultimate all-in-one set and forget ETF. We’ll look at their differences, pro, cons, how to start investing in them, and finally some alternatives that are worth considering!

Now I’m sure most of you will know, taking the plunge and deciding to invest isn’t easy. Then deciding what to invest in, well that’s even harder, as these days there are so many different options of things to invest in, from equities, bonds, property and crypto.

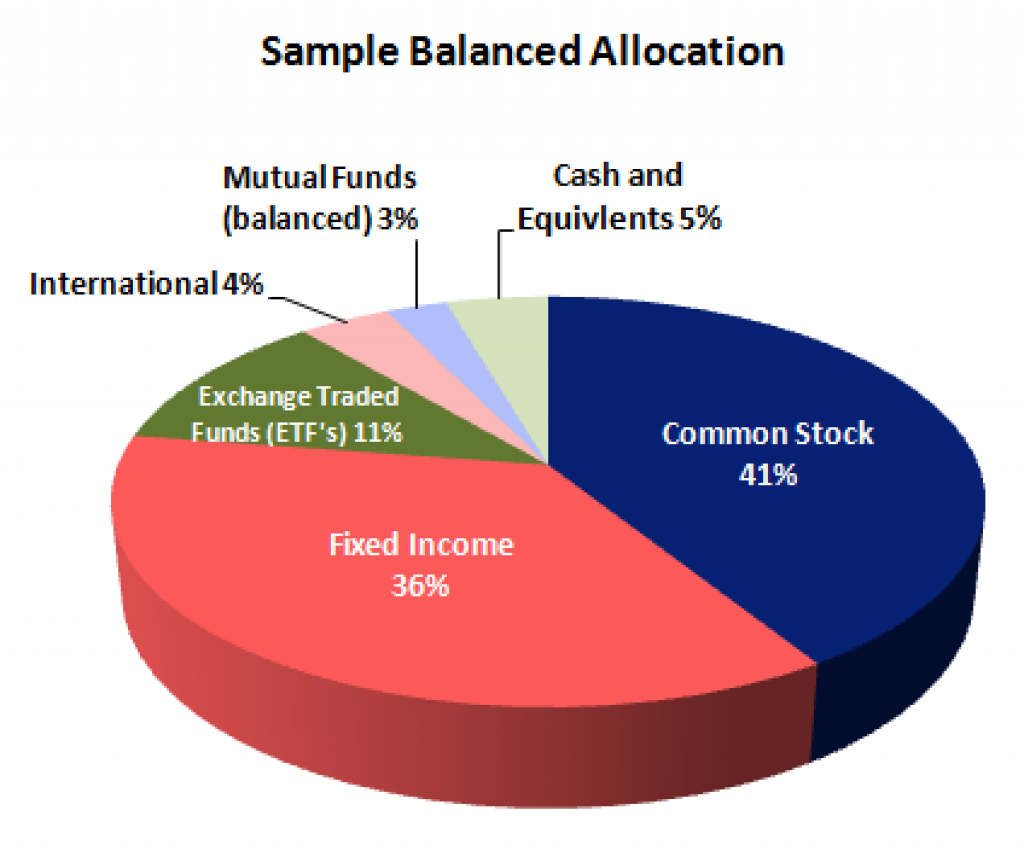

And this is where the concept of the all-in-one ETF comes into play. Multi-asset exchanged-traded funds (ETFs) offer to do all the hard work for investors. These funds blend different growth and defensive asset classes like equities, bonds and cash into a single product by investing in a handful of funds. There’s lot of different types of multi-asset funds available and they are constructed to cater for differing risk profiles like conservative, balanced and high growth, similar to products offered by superannuation funds.

What are all-in-one multi-asset ETFs (Exchange Traded Funds)?

In essence, an all-in-one ETF or multi-asset ETF is essentially a “fund of funds” or an everything index. The difference between this and a regular ETF is that a standard ETF will be tracking a single index and investing directly into stocks to track this index. Whereas a multi-asset ETF doesn’t invest directly into stocks, instead it is investing in multiple ETFs or Funds (which themselves will hold stocks directly).

This is where an “active” element actually comes into play, as there has to be some decision around which funds to use and at what allocations. Where some focus on stock picking or market timing, most of a multi-asset portfolio’s long-term returns are driven by the asset allocations.

Why does this all matter? Make more money with consistent investing

However even with this “active” component, all-in-one funds are very different to just picking individual stocks. It’s essentially the same concept of you choosing your own portfolio of ETFs, except it’s going to be way simpler to manage, you don’t need to worry about rebalancing and sticking to your set % allocations, and they remove any potential self-sabotage behavioural risk. For example you might observe on the news that Australian stocks are crashing and decide at the time to lower your allocation to Australian stocks in your ETF portfolio.

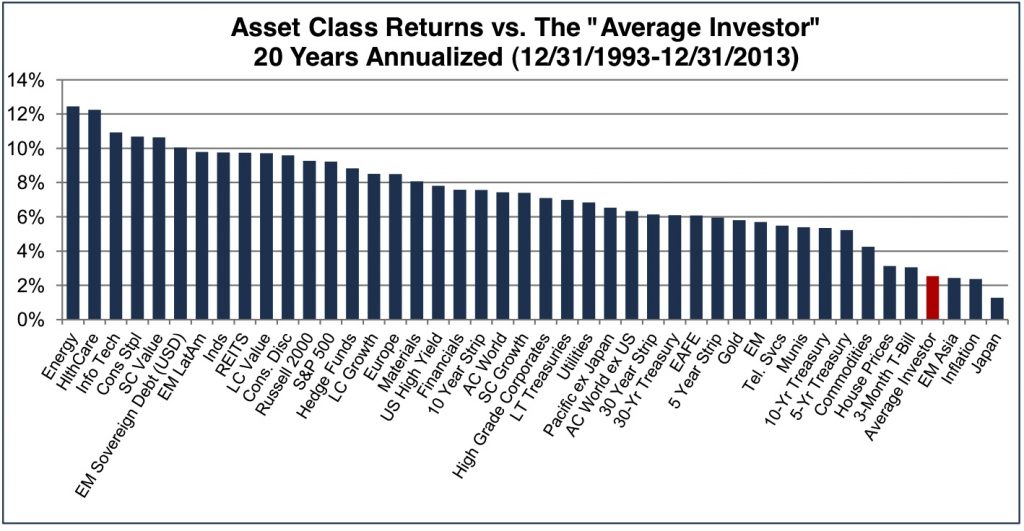

This is made super clear when you look at the performance of an average investor who does their own stock picking and trading. When you look at the data over a 20 year period, the average investor underperformed almost every asset class with a return of just over 2% per annum. Underperforming, bonds, gold, and of course the S&P 500 which returned almost 10% per annum over the same time period.

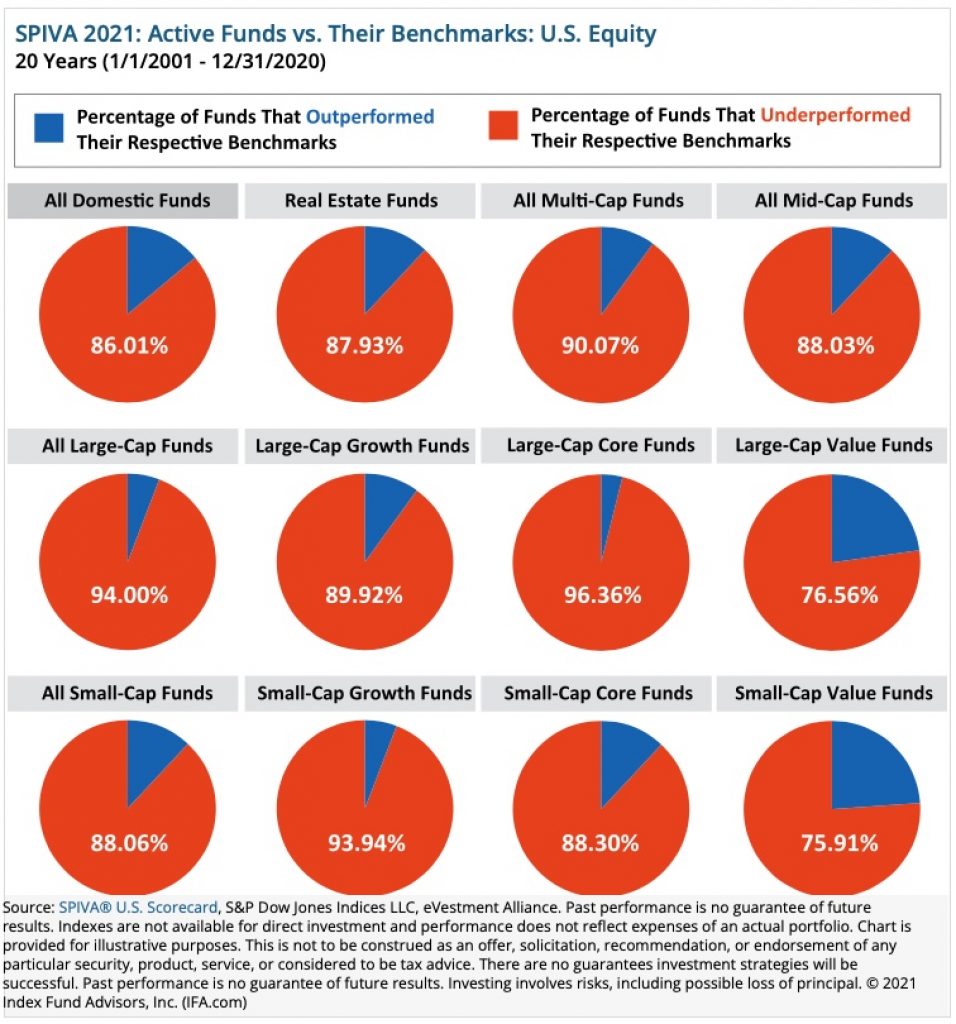

Furthermore, even the majority of investment professionals who spend their entire time trying to outperform the stock market, aren’t able to consistently beat it over a long time period. In a study done by S&P over a 20 year period, across all US funds, only around 14% of portfolio managers were able to outperform the index that they were being benchmarked against. Which is kind of ludicrous when you have to consider the fees they charge are often 10x the fees of a passive index fund or ETF.

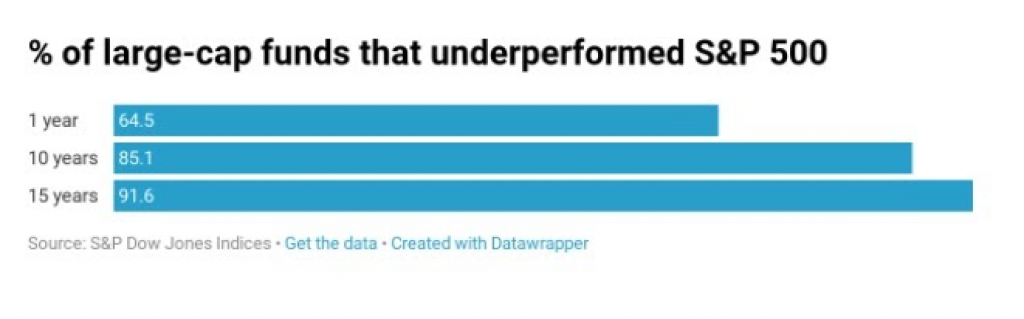

Whilst a fund manager might outperform the market for a year or two, as you extend the time period you observe this gets smaller and smaller. For example with large cap funds, over a 1 year period 64.5% of active funds underperformed the index, after 10 years, 85% underperformed and after 15 years, over 90% underperformed. I’m sure if you extended this out further, we would definitely begin to approach an extremely small percentage of funds that are able to consistently outperform the market.

This is where the all-in-one fund comes into play as the simplest way to ensure you stick to a diversified passive investment strategy, to follow the market. As we just established that stock picking is going to severely underperform the market, along with actively managed funds.

VDHG ETF ASX – Vanguard Diversified High Growth ETF

For the longest time there has been a single fund that has been recognised as the holy grail of passive investing, which is the ETF called VDHG by Vanguard. VDHG is comprised of seven other Vanguard funds, an important distinction to make here is that they are the Vanguard wholesale funds, not ETFs, I’ll explain why this is important shortly.

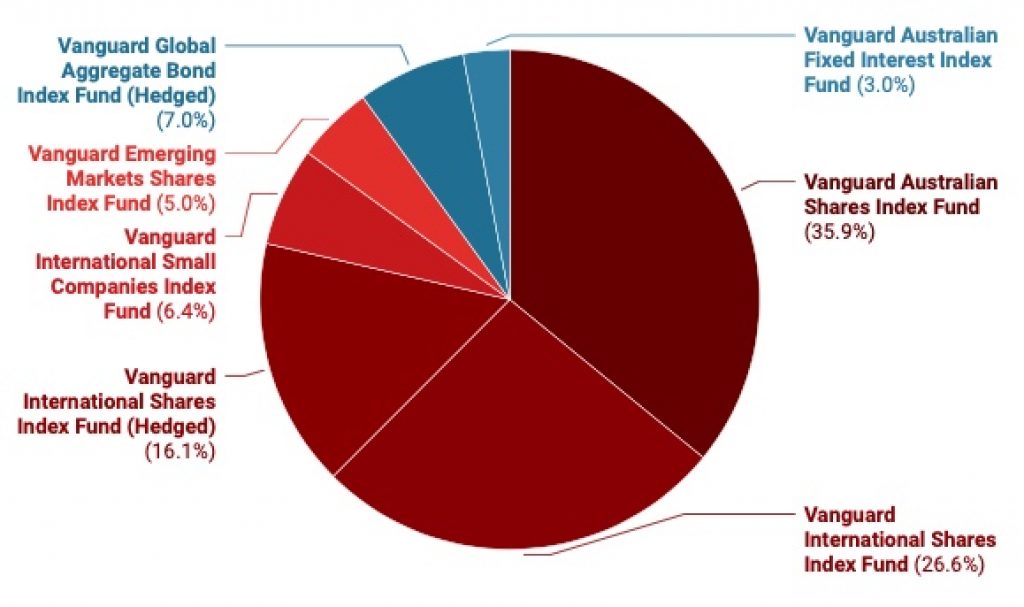

The seven underlying funds in VDHG are the Vanguard Australian Shares Index Fund (Wholesale), Vanguard International Shares Index Fund (Wholesale), Vanguard International Shares Index Fund (Hedged) – AUD Class (Wholesale), Vanguard Global Aggregate Bond Index Fund (Hedged), Vanguard International Small Companies Index Fund (Wholesale), Vanguard Emerging Markets Shares Index Fund (Wholesale), Vanguard Australian Fixed Interest Index Fund (Wholesale).

VDHG Asset Allocation

Across these seven funds there’s over 7,000 individual companies that you’re diversified across, and of course the 10% allocation to bonds. Whilst this seems pretty complicated, at a high level, you’re essentially getting exposure to, Australian large-caps, International large-caps, International small-caps, Emerging markets, and bonds. Or if you want it simplified even further. 36% Aussie equities, 54% Global equities and 10% Bonds. The only notable asset class missing is direct exposure to the property sector through something like their Vanguard Australian Property Fund.

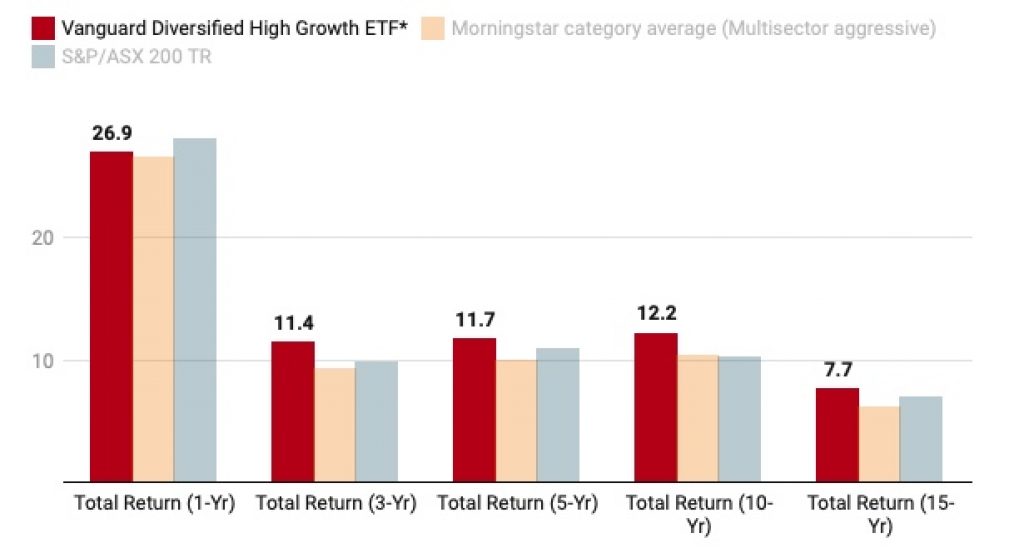

VDHG Performance

In terms of performance, VDHG has done really well in the bull market of the past year. It returned over 26% in the year ending August 2021. The ETF version of the fund launched in 2017, but the identical unlisted wholesale fund has returns going back to 2002. It’s returned 12.2% annually the last 10 years and 7.66% over 15.

VDHG Fees

It has an annual fee of 0.27% p.a which to put things in perspective would cost you $2.70 for every $1,000 you have invested. And incase you were wondering, Vanguard is not “double-dipping” on management fees here, as in, you aren’t having to pay the management fee from the funds inside VDHG and then paying another fee for VDHG. If you look at the PDS for VDHG, it reads:

“As the Funds invest in a number of Underlying Funds, Vanguard’s management fee in the Underlying Funds is fully rebated back to the Funds. This ensures investor do not incur duplicate fees.”

Now you may have already realised this but since all VDHG is doing is investing in other publicly available Vanguard funds, there’s nothing stopping you from investing in them directly. If you did this, you would actually end up at a blended management fee of around 0.19% p.a, a pretty significant difference to 0.27%. That difference of 0.08% p.a is what Vanguard takes to automatically balance the funds for you and remove the “human element” risk.

VDHG Tax Implications

Remember when I said earlier that VDHG isn’t holding ETFs inside of it and instead holding the unlisted wholesale Vanguard funds. This is important as there is actually a negative tax implication associated with these unlisted managed funds.

In a managed fund like the Vanguard wholesale funds, all the funds are pooled together, so if any investor sells units, it triggers a capital gains event for all the investors in the fund. Which means even if you didn’t sell out of the fund, you’ll still have to incur the tax liability of any capital gains. This doesn’t occur with ETFs due to their differing tax structure, where you only realise capital gains when you sell your ETF holdings.

DHHF ETF ASX – BetaShares Diversified All Growth ETF

Given the massive popularity of VDHG and passive investing, it didn’t take long for another competitor to come along and shake things up. This competitor being the DHHF ETF from BetaShares, which has its own spin on the all-in-one set and forget ETF.

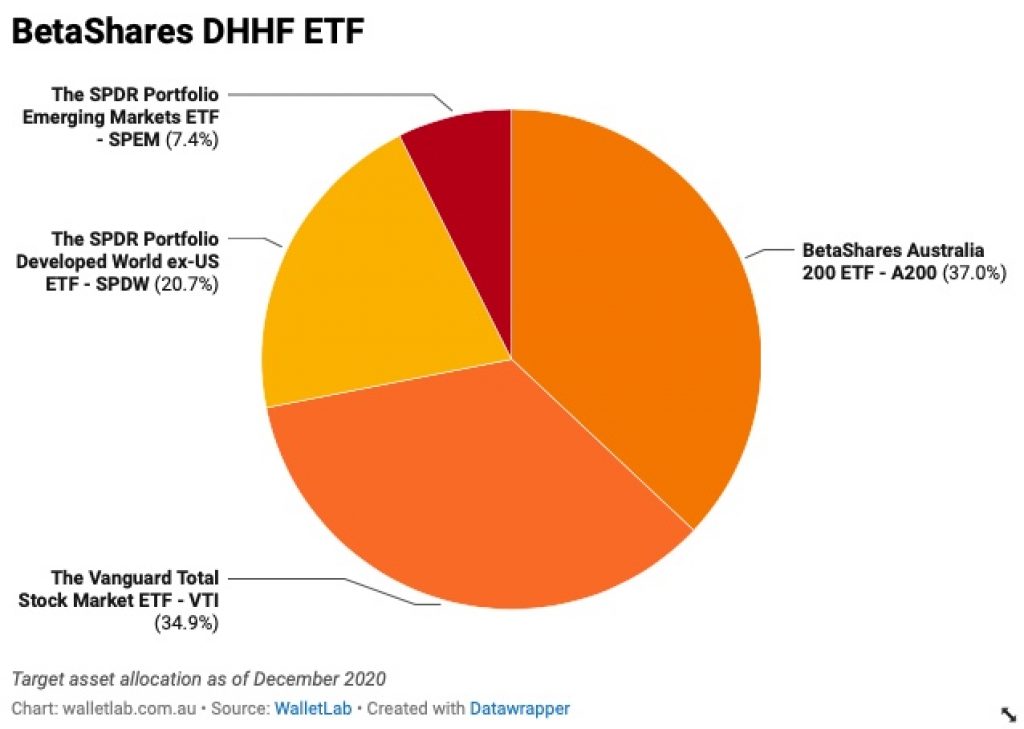

There’s four underlying funds in DHHF and this time they are actually ETFs, with over 8,000 individual stock holdings between them. These ETFs are BetaShares Australia 200 ETF – A200, The Vanguard Total Stock Market ETF – VTI, The SPDR Portfolio Developed World ex-US ETF – SPDW, and The SPDR Portfolio Emerging Markets ETF – SPEM

DHHF Asset Allocation

A200 provides exposure to the largest 200 companies on the ASX and DHHF has a 37% allocation towards it. Given that the Australian market only accounts for roughly 2% of the world’s global economy, this might seem like a bit of an overallocation. However, given that Aussie shareholders receive higher dividends than those offered by other markets, in addition to receiving tax benefits through the franking system. This often makes investing in the ASX an appealing prospect for Aussies.

VTI tracks the total US stock market and provides exposure to large, mid and low-cap companies in the US, with DHHF allocating 34.9% towards it. The US accounts for almost one-quarter of the world’s global economy and has remained the largest economy since 1871, which is why it makes sense for diversified portfolios to have a significant US allocation.

SPDW provides exposure to developed markets outside of the US and DHHF has a 20.7% allocation in this category. This prevents an over-concentration of the US market and tech sector, which might seem foolish at first but is part of a diversified strategy, since we never know which assets will outperform in the future.

SPEM rounds out the funds in DHHF with a 7.4% allocation and is used to get exposure to emerging markets. The top-weighted countries in SPEM are China, Taiwan, India, Hong Kong and Brazil, since these economies are new and have a lower overall market cap, their growth potential is typically higher than in developed markets.

Again at a high level this rounds out to DHHF having a 37% allocation towards Australian equities and a 63% allocation towards global equities.

DHHF Fees

DHHF has management fees of 0.19% p.a (or $1.90 for every $1,000 invested per year) – the lowest fee from an all-in-one diversified ETF currently available on the Australian market. However this fee is effectively closer to 0.28% due to a concept called tax drag, which I’ll explain shortly.

BetaShares confirmed via a post on their Reddit account that the management fee of 0.19% p.a is all inclusive of the fees of the underlying ETFs, and like VDHG, DHHF is not double counting on fees.

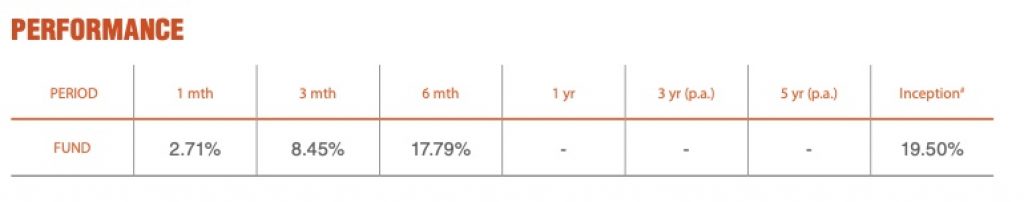

DHHF Performance

Looking at the performance of DHHF, it’s only been around since December of 2019, which means it doesn’t have a long track record to look back to. But if you look at its underlying holdings, it will perform very similar to VDHG but probably slightly more volatile (higher highs, lower lows), due to it not having any bond exposure. As of today, since inception DHHF has returned 19.50% p.a.

What’s the difference (VDHG vs DHHF)

If you’re trying to decide which one to invest in, well it really comes down to four main differences between VDHG and DHHF.

VDHG vs DHHF Comparison

| Comparison | VDHG (Vanguard) | DHHF (BetaShares) |

| Equity Allocation (Growth) | 90% | 100% |

| Bond Allocation (Defensive) | 10% | 0% |

| Australian Equity Allocation | 36% | 37% |

| Global Equity Allocation | 54% | 63% |

| Management Fees (MER) | 0.27% p.a. | 0.19% p.a (0.28% p.a. effective cost) |

| Hedging | Yes | No |

| Constructed with ETFs or Managed Funds | Managed Funds | ETFs |

Bonds vs. 100% Equities

VDHG has a 10% allocation towards defensive assets, i.e. bonds and DHHF has a 100% allocation towards equities. Bonds act as an insurance policy against volatility or market downturns, as they often become more valuable during these times. However during times of growth (which is the majority of the time with the stock market), bonds will significantly outperform equities.

Therefore if you’re planning on investing on a long time horizon, BetaShares recommends 7+ years, then 100% equities may be the right choice for you, as over the long run the returns will most likely be higher than if you had a 10% allocation towards bonds.

Management Fees

The second major difference between VDHG and DHHF are the fees of 0.27% (VDHG) and 0.19% (DHHF). As I mentioned earlier though, since DHHF contains SPDW and SPEM, which are US domiciled funds that contain non-US assets, they incur something called “tax drag”. Which occurs when an Australian fund holds US funds that hold stocks from non-US countries, as you can’t claim the dividend withholding tax credits paid by the US fund, that you normally could if your Australian fund held those non-US stocks directly.

What this means is that the management fee of DHHF is effectively much closer to 0.28% p.a which means it really isn’t that different to the fee of VDHG of 0.27% p.a

Tax Implications of ETFs vs. Managed Funds

However this brings us to the third major difference and that’s the fact that VDHG holds managed funds and DHHF holds ETFs. As I explained previously, managed funds are less tax efficient then ETFs, as you don’t control when you get to realise capital gains.

By investing in a fund that exclusively holds ETFs however, such as DHHF, these gains are not realised until the investor sells. As a result, there is more potential for capital growth, due to the full fund being able to compound over time. And by the time you actually want to start selling units of your ETF, it’s much more likely that you would be in a lower tax bracket then you would be during the accumulation phase.

Hedging

The fourth and final difference between VDHG and DHHF is hedging, where VDHG has allocation towards hedged investments and DHHF does not. Hedging, similar to bonds, is like an insurance policy, except this time, to offset the impact of currency fluctuations. Over the long run, we typically see currency fluctuations balance out and it’s typically not worth the additional cost in management fees.

VDHG vs. DHHF – What’s better?

Personally – given the potential tax implications and my long term investment horizon, DHHF is a no brainer. Regardless of which one you end up going with for your own situation, both are great investments and will mean you’re significantly going to outperform an average investor trying to pick their own stocks.

However I will go through some alternatives if you don’t mind putting in a bit of extra work to save more on fees. But with auto investment tools like Pearler available, the historical challenges of balancing a multi ETF portfolio are almost gone.

How to start investing in ETFs

But if you’re reading this and haven’t actually started investing yet or want to know how to get started investing in ETFs. Well it’s really not that complicated, all you need to do is sign up for a stock brokerage account, deposit your funds, and purchase your ETF. If you want a detailed step by step guide on how to get started with investing in ETFs, check out my beginners guide.

Cheaper (and simpler) alternative to VDHG and DHHF

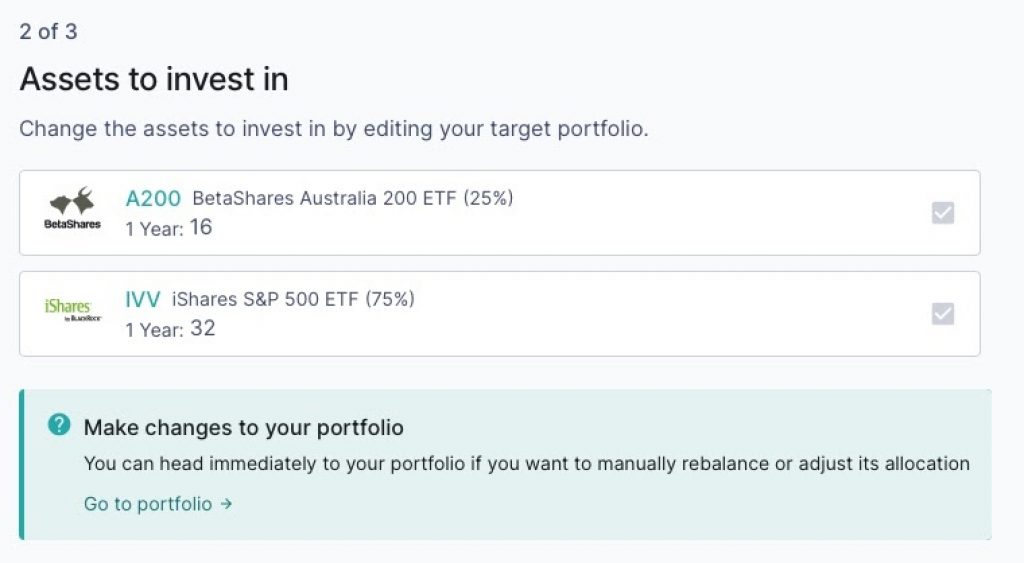

There’s a much simpler and cheaper alternative to getting a diversified ETF portfolio by using just two ETFs. This is through the BetaShares A200 ETF at 25% allocation and the Vanguard International Shares Fund VGS at 75% allocation. This is comprised of 75% International and 25% Australian exposure, giving you decent diversification to Australian companies and their sweet franking credits, as well as exposure to the rest of the world, and there’s no overlap as VGS doesn’t include Australian holdings.

Be sure to check out my full post on the two fund portfolio where I cover, why this makes sense and what the benefits are.

And there’s actually a really simple way to automate this entire process and put your investing on autopilot. That’s by using Pearler which is an investing platform available in Australia that has this really unique Autoinvest feature, that allows you to configure predefined investment instructions to automate your investing, essentially the same way an all-in-one ETF does the same thing. So you can basically tell it to invest in A200 25% and VGS 75%, set up your deposit schedule, and it will take care of the rest.

If you want to check out Pearler, sign up using my link where you’ll get a brokerage FREE trade for signing up. In addition, check out my comprehensive review on Pearler if you want to learn more about Pearler and it’s features before diving in. Finally here is a link to my public profile on Pearler, where you can follow me and my investments.

Thanks Michael,

A no nonsense comparison, rare to see these days in any field and very much appreciated.

Have taken your advice on DHHF and using Pearler commenced an autoinvest on this ETF.

The money invested is not for me but my grandchildren so it was a “no brainer” to choose given the time period involved.

Many thanks,

New Person to ETF’s.

Hey there, no problem at all – glad this article was able to shed some insight on how to invest over the long term.

pearler seems to be one of the first brokers in australia to offer auto-invest and autobalance based on percentages. signed up using your code:)

Definitely the first one I’ve found that offers this feature, I’ve been using it for the last 6 months and its been great!

Is the below right?

However during times of growth (which is the majority of the time with the stock market), bonds will significantly outperform equities.

Whats up this is somewhat of off topic but I was wondering if blogs use WYSIWYG editors or if you have to manually code with HTML. I’m starting a blog soon but have no coding know-how so I wanted to get guidance from someone with experience. Any help would be enormously appreciated!