Intro

The cheapest ASX brokers in Australia has gotten extremely competitive the last few years with more people investing than ever before, causing investment levels hitting record highs. And with more people caring about their money, this has meant the competitive landscape for companies willing to help people invest their money has also got more fierce than ever as well!

If you asked me at the start of 2020 which broker you should use to purchase Australian stocks on the ASX, I would always recommend SelfWealth as the clear cut choice. However it seems in less than 2 years that there has been an implosion of new ASX brokers who have entered the space, with very attractive offerings. If you’re also looking for a step by step guide on how to actually start investing, check out my post on How To Start Investing In ETFs in Australia.

In this post I will cover what I think are the 5 best ASX brokers in terms of cost available in Australia and how they compare to each other across 8 main factors.

- Brokerage

- Minimum investment amount

- US Shares

- CHESS status

- Instant deposits

- Account keeping fees

- Market/limit orders

- Mobile app experience

And at the end of the post I’ll provide what I think are the best low cost Australian ASX broker investing platforms to use from these top 5, depending on your preferences and needs.

Let me know in the comments if you would like me to do a deep dive into any of these investing platforms, as I’ll try to keep this comparison high level and objective, without going into the finer features of each broker which might be a more subjective.

What is CHESS and why does it matter for shares?

Before I dive into the list I just want to quickly touch on CHESS and why it’s important. And I’m not talking about the oldest game in the world, I’m talking about CHESS sponsorship in regards to your shares.

Established over 25 years ago, CHESS (Clearing House Electronic Subregister System) is a computer system used by the Australian Securities Exchange (ASX) for share settlements and registrations.

CHESS functions:

- Facilitating share trade settlements – CHESS usually settles a trade 3 days (T+2) after a buyer and seller agree to trade by arranging the transfer of money between the buyer and seller. It also transfers legal ownership of the shares at this time.

- Registering share ownership – CHESS is also a sub-register that the ASX maintains which keeps track of who owns what shares.

What does it mean to be CHESS sponsored?

If your shares are ‘CHESS sponsored’ it means when you buy shares, the ASX has a record of you directly owning those shares.

Here’s how it works:

- When you choose a broker whose shares are CHESS sponsored, the broker will issue you a Holder Identification Number (HIN).

- When you buy shares, they will be assigned to you, via your HIN, and a statement will be sent to your registered address.

- You can have multiple HINs at multiple online brokers, and you can move your HIN (and the shares assigned to it) from one broker to another, and from one HIN to another.

Advantages to having CHESS sponsored shares

There are a number of advantages to having CHESS sponsored shares, including:

- Third-party verification – Because your shares are tied to your HIN (and therefore to your name and Tax File Number), CHESS acts as a third-party verification that you own the shares directly, as opposed to someone else holding them on your behalf.

- Single subregister – Rather than having shares in different companies spread across several subregisters, your entire portfolio can be registered under one HIN. This makes it possible to track down all your holdings.

- Minimised paperwork – Rather than receiving physical share certificates, CHESS issues a single statement at the end of the financial year.

- Easy updates – If you need to update any of your personal information such as your name, address, or Tax File Number, you can update it with your CHESS sponsor (your broker) once, rather than having to notify several subregisters.

Can you own non-CHESS sponsored shares? (Yes, but there are disadvantages)

Because most of the major Australian brokers offer CHESS sponsored shares, they are very popular with Australian investors. Having said that, it is possible to trade non-CHESS sponsored shares – they include:

- Shares purchased via a custodial broker – Some brokers (including many robo-advisers and micro-investing apps) operate under a custodial model, meaning they hold the shares on your behalf. While many of these brokers have been around for a long time and are trusted by investors around the world, it is important for investors to do their research and understand what would happen if the broker were to go under. In addition, if you own shares via a custodial broker, you might miss-out on things like voting rights and dividend reinvestment plans.

- Issuer Sponsored Shares – These are managed by the issuer of the shares via the issuer’s share registry and are usually the result of an IPO, SPP or ESP (Employee Share Plan). Rather than being tied to a HIN, these are allocated a Security Reference Number (SRN).

If you’re like me and are a massive fan of the CHESS sponsorship model, smash the like button for CHESS and the Youtube algorithm. With that out of the way lets get onto the first broker, SelfWealth.

SelfWealth

Overview

SelfWealth was established in Australia by Andrew Ward in 2012 as a fin-tech start up that offered a low cost alternative to the established brokers like CommSec.

By using modern technology and a minimalist online-only solution, SelfWealth was able to offer an industry-leading flat fee brokerage cost, regardless of the size of the trade. This made SelfWealth a powerful disruptor in the stock broker industry in Australia.

Brokerage

Firstly, in terms of brokerage SelfWealth has a flat-fee regardless of the size of the trade of $9.50. Super simple and very low cost, when the average of most established brokers is around $20.

Minimum investment amount

The minimum investment amount on SelfWealth is $500 for your initial investment, from thereon there is no minimum trade value, you’ll just need enough to cover both the share cost plus the brokerage cost of $9.50.

US Shares

Yes, SelfWealth supports US share trading now, at the cost of $9.50 USD brokerage per trade. You’ll also be a charged a currency conversion fee of 0.6% when you convert from USD to AUD and vice versa! So, not that cheap and I’d probably just stick to getting US shares via Australian ETFs on the ASX. But if you really want to hold specific US shares you will at least have the option.

CHESS status

SelfWealth is CHESS sponsored and you will get to use your own HIN and be the official registered holder for all shares.

Instant deposits

One of the annoying things about SelfWealth is that it still doesn’t support any form of instant deposits, like PayID. The best you can hope for is next day if you BPAY early in the day, which can be quite frustrating if you want to make an urgent trade. But for most people who are investing for the long term this shouldn’t be a massive problem.

Account keeping fees

The standard SelfWealth account doesn’t have any account keeping fees. There is a premium option that costs $20 a month, but it isn’t necessary to get, and frankly isn’t worth it.

Market/limit orders

SelfWealth supports both market orders and limit orders. If you aren’t sure what a market order or limit order is, basically when you place a market order, you don’t select a price, and the order will be made at whatever the lowest sell price is. Whereas with a limit order, you select a specific price, and orders will only be executed if there is someone willing to sell for that price.

Mobile app experience

In terms of the SelfWealth mobile app, its pretty average, not great, not bad. Easy enough to place orders and do what you need to do. But there’s a lot of random unnecessary features like their “WealthCheck” score, which seems completely arbitrary

SelfWealth Review

In my opinion, SelfWealth is a great way for Aussies to buy shares, the $9.50 flat-fee CHESS-sponsored structure, and general no fuss, no frills, simple and easy to use system makes it a great choice for people chasing financial independence. Even though it might take a while for transfers to go through, and it can take a while to get customer support, its a small price to pay for such cheap brokerage, with the comfort of a company that’s been around for a while now with a good track record.

Sign up to SelfWealth here and get 5 free trades.

Superhero

Overview

Superhero trading is one of the newest ASX brokers available in the Australian investing market, having launched in September 2020. Offering an industry leading $5 brokerage per trade and a minimum trade amount of only $100 (most conventional brokers have a minimum of $500).

Brokerage

Superhero has a brokerage fee of $5 per trade, flat rate. And for all ASX ETFs, there is $0 brokerage, which is unprecedented and quite amazing.

Minimum investment amount

Superhero Share Trading Platform has a $100 minimum investment amount.

US Shares

Superhero now supports US share trading, with very competitive costs. $0 brokerage for all trades, with just a 0.5% currency conversion fee, lower than both Stake and SelfWealth.

CHESS status

The lack of CHESS sponsorship is where Superhero falls over, and is also the reason they are able to offer low fees and minimum investment amounts. Essentially, Superhero uses a custodian model which is fairly common among brokers including Vanguard Personal Investor and IG, as well as by micro-investment apps such Raiz and Spaceship. This means shares bought on Superhero are beneficially held in your name but no registered in your name, like they would be if they were CHESS sponsored under your own HIN.

According to Superhero’s CEO John Winters, the custody model still uses the CHESS system however it utilises a single HIN on ASX’s CHESS system, that all users share. Superhero’s tech consolidates settlements at the end of the trading day to reduce costs.

If something ever happened to Superhero or one of the external suppliers they work with, it would potentially impact your investments because those investments are not owned by you.

Instant deposits

Superhero supports PayID, which means you are able to instantly deposit funds into your account. This is a very handy feature, combined with low brokerage make Superhero quite attractive to use.

Account keeping fees

Superhero has no account keeping fees, keeping with the low-cost theme of this comparison review.

Market/limit orders

Superhero supports both market orders and limit orders.

Mobile app experience

Superhero’s mobile trading app is super simple to use and very similar to Robinhood in terms of the user experience, which is a popular US share trading app. You can view your dashboard to see your overview, navigate to their invest tab where you can make investments, view your trading activity, keep tabs on your brokerage account balance through the wallet, and view your profile and reports to track performance and tax liabilities.

Superhero Review

Superhero provides all the tools you need to make share investments and put your money to work for you – all at a super low cost (or in some cases no cost). You can start by investing as little as $100, and there’s a dashboard that allows you to access your portfolio at the touch of a button. Overall, it’s accessible, easy to understand, and super affordable, with the one downside (which may be a blocker for some) of no CHESS sponsorship on the holdings.

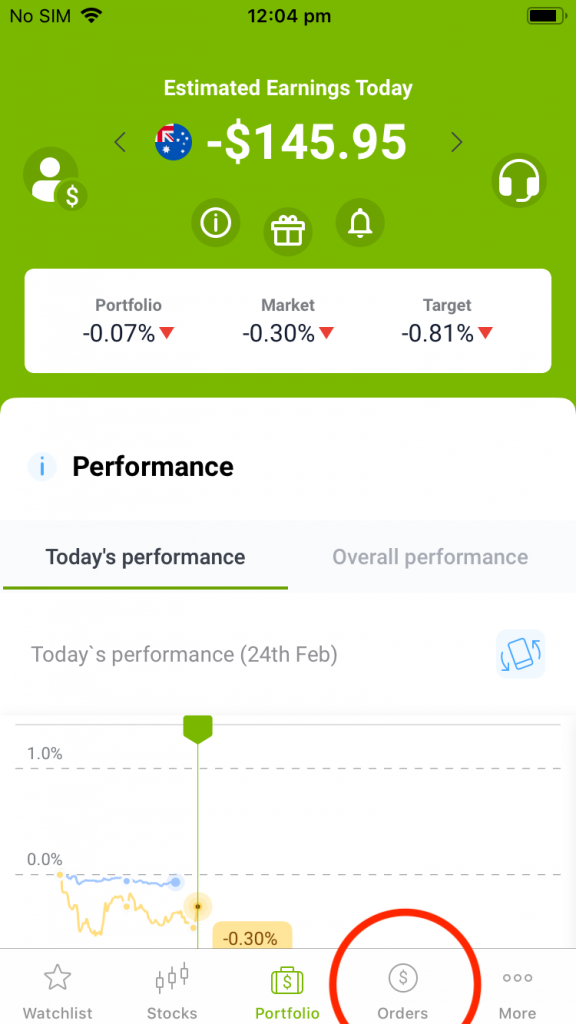

ThinkMarkets

Overview

Established in 2010, ThinkMarkets is a premium multi-asset online brokerage with headquarters in London and Melbourne and hubs in the Asia-Pacific, Middle East and North Africa, Europe and South America. Originally starting out with a CFD product, ThinkMarkets launched their ASX share broker product in 2020.

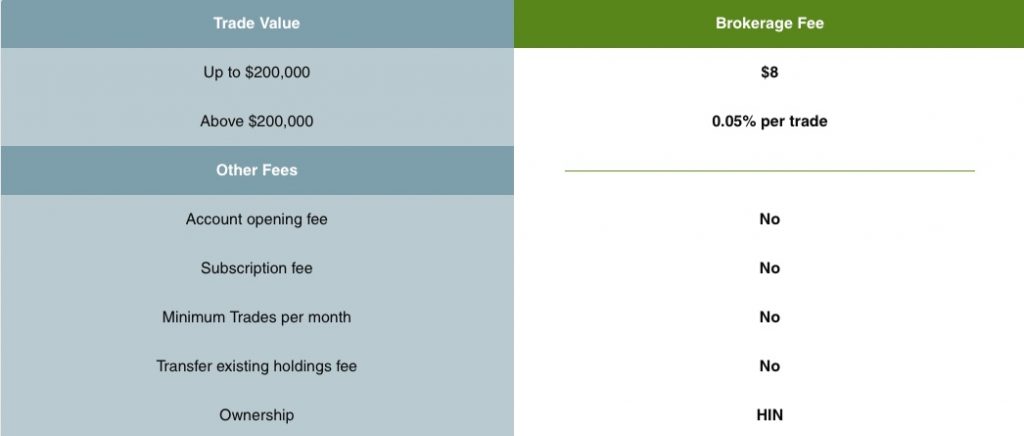

Brokerage

The brokerage for ThinkMarkets is $8 for trades up to $200,000 and 0.05% of the trade value for amounts over $200,000. This is effectively a flat rate of $8 a trade, as the majority of us will not be making trades of over $200,000. And if you were in the scenario of where you might need to, you could just break up your trades into parcels of $200,000, which would be more cost effective than 0.05% of $200K, which is $100.

Minimum investment amount

The minimum investment amount for ThinkMarkets share trading on the ASX is $500 for your initial investment. Otherwise you need at least the value of the share you are trying to trade, plus brokerage.

US Shares

You currently aren’t able to trade US shares via the ThinkMarkets share trading platform. They do have a CFD product, but I would not recommend using any CFD product.

CHESS status

ThinkMarkets supports your own HIN and fully sponsored CHESS holdings, which makes it quite secure.

Instant deposits

The ThinkMarkets share trading platform actually has a deposit method for instant transfers. It doesn’t use PayID, it actually uses this 3rd party transfer service called Poli which has been around for a while. Poli supports instant transfers for up to $50,000 per deposit.

Account keeping fees

There are no account keeping fees or fees for creating an account with the ThinkMarkets share trading platform on the ASX.

Market/limit orders

ThinkMarkets supports both market and limit orders, allowing you to choose the exact price you would like to buy or sell if needed.

Mobile app experience

The ThinkMarkets mobile app for share trading is fairly comprehensive in terms of features, allowing you to easily buy and sell shares. It also has some fairly sophisticated charting analysis you can do. However it isn’t the easiest app to use and doesn’t have the nicest interface when compared to something like Superhero or Stake, but again its usable and will get the job done.

ThinkMarkets Review

Overall ThinkMarkets is actually a great offering, with low cost brokerage of only $8, with the added security of having your own CHESS sponsored HIN.

Pearler

Overview

Pearler launched at the start of 2021 and offers a range of features that are tailored for users who are interested in long term investing. They’ve got some pretty unique automated investing tools which are pretty useful; specifically their Autoinvest feature to put your investing on autopilot, and their Autodeposit to build your cash account.

Brokerage

Brokerage costs for Pearler are currently $9.50 across the board with the added benefit of free brokerage on some ETFs if you hold them for over a year. The way it works is if you buy one of these special ETFs, you don’t pay any brokerage, but if you choose to sell some within the year, you have to pay both the buy and sell cost ($19, $9.50 per buy/sell). Currently there is a list of over 45 ETFs that have free brokerage from ETF managers, eInvest, ETF Securities and VanEck (check out my post on the best VanEck ETFs to consider investing in).

Minimum investment amount

There is no minimum investment amount on Pearler, which is fantastic for people who would like to get their feet wet with investing. From their website:

Pearler has no minimum order size. However, customers should consider the fact that with our $9.50 flat brokerage fee, that the smaller an order is, the higher proportion you’ll be paying in fees with respect to the total investment value.

Some brokers have minimum first orders of $500. Why doesn’t Pearler?

We don’t have a minimum, because Pearler is comfortable with you choosing the investment size that is right for you. However, please note that most market participants and registries generally consider volumes of shares less than $500 to be unmarketable parcels.

A good callout in regards to brokerage as a percentage of your trade, so typically you would want to keep this under 1%, which would require you to have a trade size of around $1,000.

US Shares

Update 10/08/2021: Pearler now supports purchasing US shares.

You can not currently purchase US listed shares directly through Pearler. However, like any other ASX broker you can purchase ETFs that may hold US shares in them, if you would like to get international exposure.

CHESS status

All holdings in your Pearler account are CHESS sponsored with your own HIN, when registering you can choose to create a new HIN or transfer your own existing one (along with all the holdings associated with that HIN).

Instant deposits

Update 02/10/2021: Pearler now supports instant deposits via PayID

This is where Pearler is a bit different, there isn’t actually a way to self-transfer funds into Pearler. The only way is to enable direct debit, and it isn’t instant, took around 3 days in my own personal experience. This makes sense, given that Pearler is marketed towards long term investors who wouldn’t have as much need for instant deposits.

Account keeping fees

There are currently no account keeping fees or sign up fees with Pearler.

Market/limit orders

Pearler supports both Market and Limit orders. However there isn’t any live pricing within Pearler itself to see buy and sell orders, you only see a “market price”. This makes it very difficult to place limit orders with just Pearler, and you will need access to another service that will provide live buy/sell trades.

Mobile app experience

Update 10/08/2021: Pearler now has a mobile app.

There is currently no mobile app for Pearler, however the website itself is quite easy to use and does work well on Mobile. There’s also a lot of additional features, like being able to set your own portfolio structures and follow other profiles. Feel free to follow my Pearler profile here.

Pearler Review

Pearler is a great new entrant in the low-cost broker space in Australia, and is actually offering some unique features that make it stand out from others. Whilst it isn’t the cheapest in any single area, it does make up for it with those features, and is still a low cost option with the security of CHESS sponsorship.

If you want to sign up to Pearler, use my referral link by clicking here to get a FREE trade.

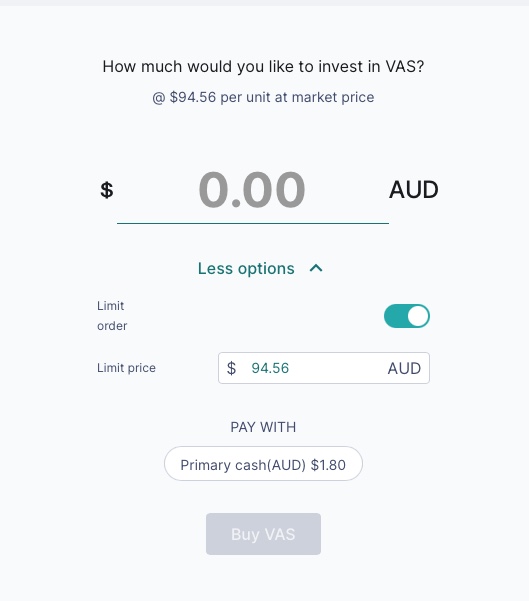

OpenTrader

Overview

Last but not least we have OpenTrader, which has been around since 2014. Opentrader is a joint venture between Openmarkets, one of Australia’s largest retail stockbrokers, and TradeFloor, Australia’s leading technology provider of derivatives risk management software and trading platforms. OpenMarkets actually provides the stock brokerage and clearing technology behind a lot of well known investing platforms, like SelfWealth and Raiz for example.

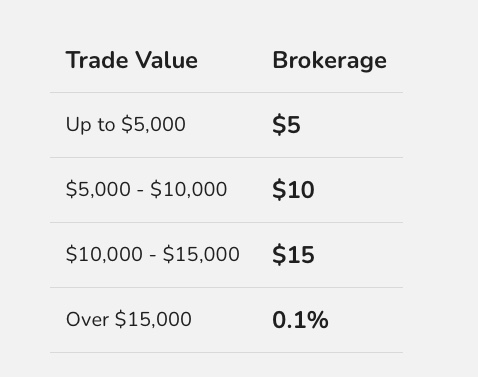

Brokerage

The brokerage fees for OpenTrader start at $5 for trades up to $5,000, $10 for trades from $5,000 – $10,000, $15 for trades from $10,000 – $15,000, and 0.1% for any trades over $15,000. This is basically a rate of 0.1% across the board as a best case scenario if you’re trading at the upper value of each brokerage fee range.

Minimum investment amount

OpenTrader like many other brokers has a minimum investment amount of $500. The minimum Buy Order of $500 is required for new securities in your portfolio, unless you already own $500 worth of that particular stock.

US Shares

You currently can not trade US listed shares directly through OpenTrader.

CHESS status

All holdings in your OpenTrader account are CHESS sponsored with your own HIN.

Instant deposits

There is no functionality in OpenTrader for instant deposits through PayID or Poli. The only way to deposit funds is through bank transfers, and it takes usually 2-3 business days to process.

Account keeping fees

There are no account keeping fees or sign up fees with OpenTrader.

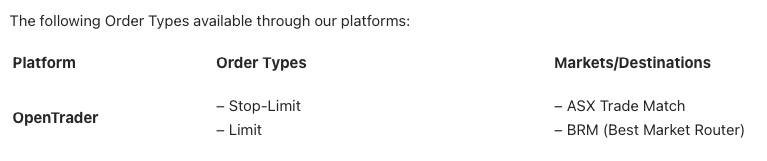

Market/limit orders

Currently there are only stop-limit orders and limit orders available through OpenTrader. Strangely there doesn’t seem to be a way to do market orders.

Mobile app experience

There is no OpenTrader mobile app at the moment, but again I have found their website quite usable, and it also works well on mobile. There are a number of features in OpenTrader like custom dashboards, price alerts, and charting, that make it stand out from the other low cost options in this comparison review.

OpenTrader Review

In conclusion I think OpenTrader is an easy to use platform that has a place in the market for secure CHESS sponsored trading, for users just starting out with trades up to $5,000. If you’re looking to trade for values more than $5,000 it makes more sense to use one of the other brokers in this list, as OpenTraders brokerage then becomes $10.

What is the best low-cost ASX broker in Australia?

| Feature | SelfWealth | OpenTrader | Pearler | Superhero | ThinkMarkets |

|---|---|---|---|---|---|

| Brokerage | $9.50 | $5: Up to $5,000 $10: $5,000 – $10,000 $15: $10,000 – $15,000 0.1%: Over $15,000 | $9.50 Free brokerage on some ETFs if you hold them for over a year | $0 Brokerage to Buy ETFs $5 Brokerage on ASX shares | $8 brokerage Up to $200,000 0.05% per trade for amounts over $200,000 |

| Minimum investment amount | $500 | $500 | N/A | $100 | $500 |

| US Shares | Yes | No | Yes | Yes | No |

| CHESS status | Yes | Yes | Yes | No | Yes |

| Instant deposits | No | No | No | Yes, PayID | Yes, POLI |

| Account keeping fees | None | None | None | None | None |

| Market/limit orders | Both | – Stop-Limit – Limit | Both | Both | Both |

| Mobile app experience | Average | None | Good | Good – simple | Good – for advanced users |

The best broker to use will really depend on your situation, but there definitely is some clear cut winners from this list for specific use cases, which I’ll highlight below.

Best and most affordable ASX broker in Australia if you DON’T care about CHESS

The best broker to use in Australia if you don’t care about CHESS is clearly Superhero, with the lowest flat rate brokerage of $5 and $0 brokerage on all ETFs, its extremely competitive, if they were CHESS sponsored they would be an absolute stand out winner for best broker in Australia. However since they are not, you need to consider the risks of no individual HIN if you want to use Superhero.

Best and most affordable ASX broker in Australia if you DO care about CHESS

From a purely objective standpoint, the best broker here in terms of cost, is probably ThinkMarkets with $8 brokerage, however if you’re buying a lot of ETFs from Pearler’s free trade list, and enjoy their automated investing features, well then they might actually come out on top here. Personally I am mainly buying ETFs for long term investing, so Pearler edges out on top for me here, even though their standard brokerage is $9.50. If you would also like to try out Pearler and get a FREE trade, please use my referral link by clicking here to sign up to Pearler.

I will just add that if you’re usually trading for amount under $5,000 (that aren’t ETFs), then the best platform to use is actually OpenTrader, as they have $5 brokerage (for trades under $5,000).

Conclusion

So there you go those are the best and cheapest low-cost ASX brokers to use in Australia for share trading. I’m sure these will be eventually changing over time but as of right now these are the rankings based off their current pricing and features. Let me know in the comments if you’re using any of these platforms or if you’d like me to do an in-depth review on any specific investment platform.