In this post I will describe my experience with margin loans for passive long term investing and how you can use leverage to kickstart your investing snowball with relatively low risk.

Now before I get into my exact margin investing strategy I’ll give you guys a crash course on what margin lending is, the benefits of a margin loan for investing (I’m going to go this in a lot of detail – there’s actually some amazing tax benefits which I’ll also go through with you), the risks associated with margin loans (as there is risk even with my conservative strategy and you need to be aware of them), how you can actually invest with margin in Australia and finally I’ll breakdown my conservative margin investing strategy for long term growth.

What is margin lending or what is a margin loan?

So for you guys who know nothing about margin loans or leverage investing. Margin loans are essentially borrowing money to invest. Very similar to how you get a mortgage to buy a property, where your property acts as security to back the loan and effectively leverage your initial deposit. With a margin loan your shares and investments act as security and leverage that let you borrow money to buy more shares. At a fundamental level a margin loan is a type of secured loan.

And again similar to how when you buy a property the maximum amount you can borrow will depend on this thing called LVR, which stands for “Loan to Value Ratio”. The higher the LVR the more money you are borrowing compared to your initial deposit. For example a 75% LVR means you can make up a total investment with a minimum of 25% your money, and a maximum of 75% borrowed money. So with $2,500 you’d be able to borrow up to $7,500 (Making up a total portfolio of $10,000). In the case of a margin loan, lenders will assign different LVRs against individual investments, so VAS for example might have a maximum LVR of 75% as they deem it relatively safe whereas a more volatile investment may have a maximum LVR or 50%

Why use a margin loan and what are the benefits of a margin loan?

There’s really 3 key reasons why I use margin to invest in Australia.

The first thing is that it allows you to get magnified returns and really kickstart your investing journey, during the most difficult stage of investing, which is the accumulation phase. It allows you to get that snowball effect much earlier on, as long as your overall investment return is greater than your margin loan interest rate (and I’ll show you some tips on how to make this much easier).

Secondly, all interest that you accumulate on a margin loan used for investments is tax deductible. This isn’t something that’s really well known and obviously only applies to specific countries but here in Australia it does apply. And I’ll show you how it actually amplifies your return over time by quite a margin as it reduces your effective interest rate.

But before that, the last main benefit of margin loan investing in Australia well actually just a general benefit with margin loans is that they actually behave in quite a unique way that is different to most standard loans like a mortgage or a car loan. Margin loans typically do not have a fixed term, by that I mean they do not need to be paid back over a certain period of time, like how a home loan might be over 30 years. This is because your accumulated interest is actually just capitalised back into the loan or “added to” the loan. This means that you don’t have any monthly loan repayments which is a great benefit for both cash flow and just ease of use.

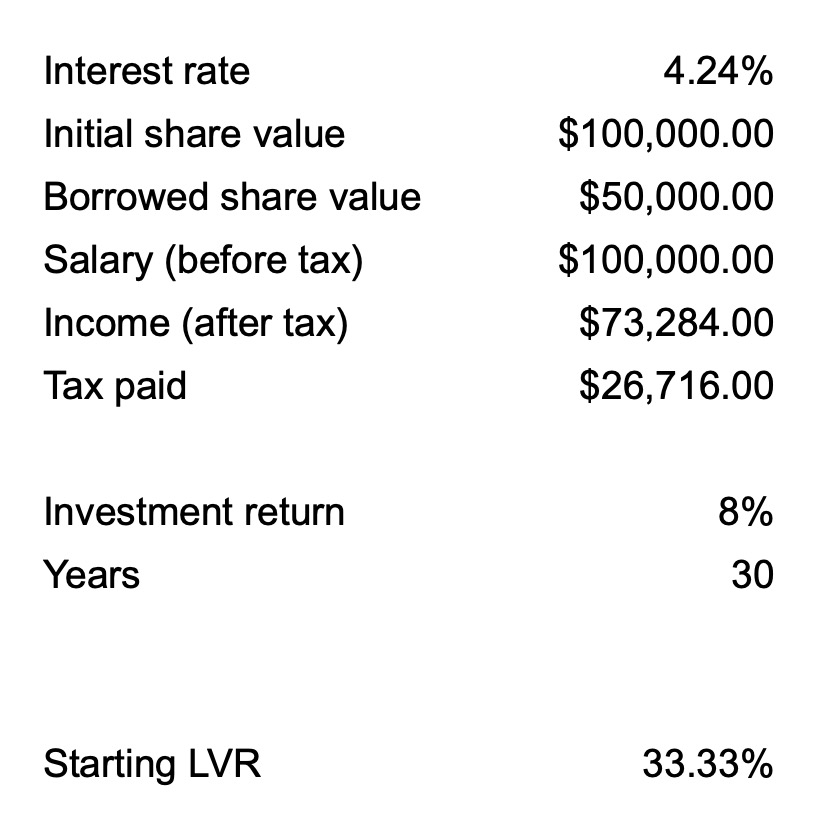

Now this is going to get pretty nitty gritty into the math but let me run through an example using a spreadsheet that I quickly put together to paint a picture about the potential benefits of a margin loan for you. So in this example we are using a margin loan interest rate of 4.24% with an initial share portfolio value of $100,000, where you would borrow an additional $50,000 taking your LVR to 33%. And for the tax calculations we will use the assumption that your salary is $100,000.

So using these assumptions you can use paycalculator.com.au to show that in a simple case where you have no deductions your income after tax would be $73,284.00 and you would have paid $26,716.00 in tax.

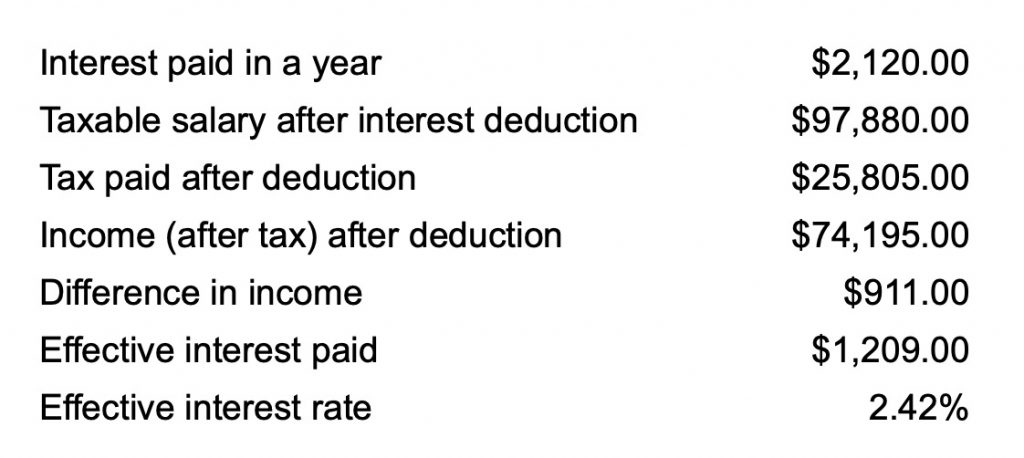

In the simple case where your investment return is 8% over 1 year. The amount of interest you would have paid is $2,120. Which we can use to reduce your taxable income. So your effective taxable salary would actually now be $97,880 and the amount you would pay is $25,805. Making your after tax, after deduction income $74,195. Which is a net gain of $911 from your previous after tax income of $73,284 because that’s how math works. Now this is where things get interesting since we’ve essentially gained an instant $911, we now reduce the amount of interest paid by that amount to calculate our effective interest rate paid over the year. So our effective interest paid is our old interest paid $2,120 less the saving of $911 which equals $1,209. Which means our effective interest rate goes from 4.24% to 2.42%. Now keep in mind this is a very simplified example and will vary depending on your salary and marginal tax rate.

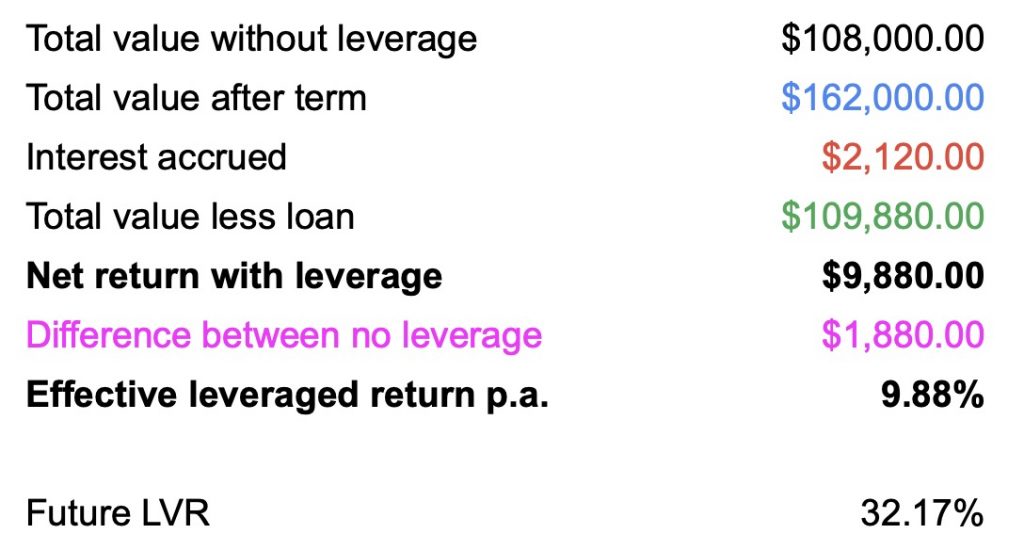

Now that’s just the interest rate and savings, in terms of the returns, firstly without using the margin loan at all your return of 8% on $100,000 means you would end the year at $108,000. However let’s compare it to the case where you do take the $50,000 margin loan, then you would have ended the year with instead $162,000. But we need to subtract the loan amount and interest accrued over the year to calculate your net equity. This comes out to $109,880. The difference being $1,880 over the year vs no margin loan, your effective leveraged return is then almost 10%, rather than 8% with no margin loan. Also notice your LVR has dropped by about 1% as well. Return in dollars over the year is $9,880 vs $8,000 an improvement of 23.5%.

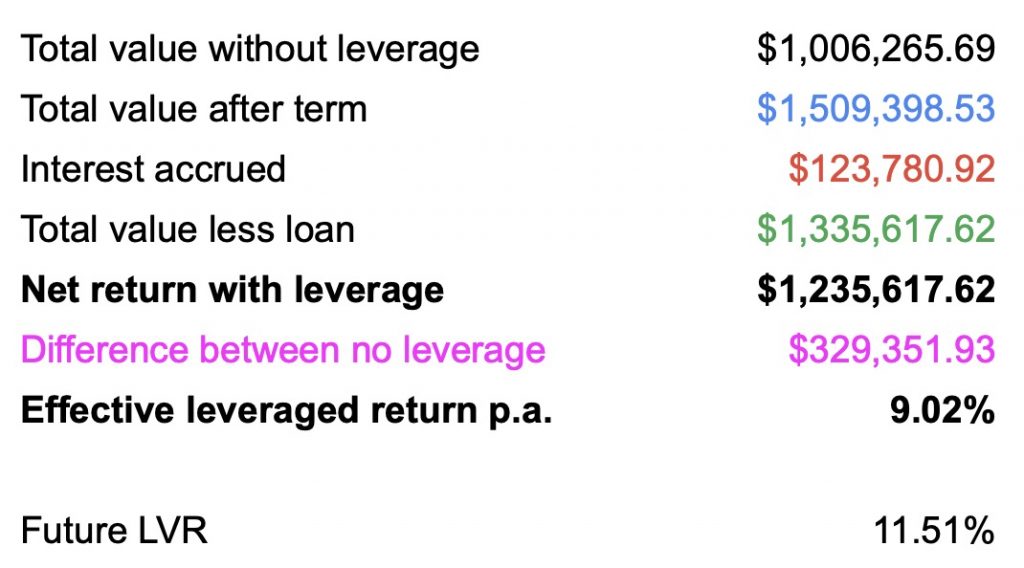

However that’s just over 1 year, if we look at this over 30 years and in a really simplified case where we don’t even look at additional purchases over that period the difference in end value would be over $300,000, where your LVR would have actually reduced to 11.51%. But let me know in the comments if you would find that spreadsheet useful and I’ll clean up the spreadsheet to make it much more usable for you guys and share it in a follow-up post.

Now I hope it’s obvious what the potential benefits of a margin investing strategy could entail but I want to also go over the potential risks of using a margin loan.

What are the risks of a margin loan?

The first risk is the potential for a margin call, a margin call occurs when the value of your portfolio falls below the lender’s required amount. This is usually in relation to the LVR on your investments and can vary depending on the value of your securities and which securities you are holding. But is typically around 60-70% LVR. In this event the lender will usually ask you to either provide more securities or cash to increase the value of your portfolio above the required amount, or if you are unable to do this they will liquidate part or all of your portfolio in order to meet this requirement. This is an extremely worst case scenario as usually this will occur as the market is dropping which is the worst possible time to be selling shares.

The next thing you need to be aware of is that similar to how you get magnified gains, you will also get magnified losses. For example if you had $100,000 with a $50,000 margin loan and the market dropped by 5%, instead of normally only losing $5,000 you would have actually lost $7,500. Which is really why I would only think about using margin for long term investing where you are able to ride out volatility in the market.

The last main risk is a risk of any variable rate loan, where interest rates can obviously vary and go up, which will hurt your returns and potentially if they get high enough, make margin investing no longer a valid strategy. If your investment returns aren’t greater than your effective interest rate of the margin loan then it is pointless to get a margin loan.

So now in terms of how you can actually invest with margin in Australia. I’ve mentioned margin loans and there’s plenty of lenders who provide this type of loan, personally the one I’m using is called Leveraged as they have the lowest interest rate at the time of this post. Let me know in the comments if you want me to do a detailed review on the different margin loan providers in Australia and their margin lending platforms (as they are not that straightforward to use).

However there are actually multiple other ways you can invest with margin. If you currently have a mortgage with a redraw facility you could actually get a much lower interest rate with the same tax benefits of a margin loan. However you don’t get the benefits of not having any loan repayments and obviously you are potentially risking your property if you aren’t able to meet loan repayments.

Another way to achieve leverage without needing to get a loan is by using things called leveraged ETFs which actually have built in leverage or margin, they will usually have higher management fees and something called volatility drag, which really simply will either amplify your returns or losses even further in bull or bear markets. And in markets that are mostly sideways they suffer from a thing called leverage decay which would erode away at any returns and is caused by the daily rebalancing of the ETF. Let me know if you want me to cover leveraged ETFs vs margin loans in Australia. Then finally there are things like CFDs, option calls or other extremely complex financial instruments, often extremely leveraged, and you actually have the potential to lose more than your initial outlay amount. I would highly recommend avoiding these.

Margin Loan Investing Strategy

So I’ve covered what a margin loan is, the pros/cons, and how you actually invest with margin in Australia. Now I want to actually outlay a strategy I’m using to achieve leveraged returns with relatively low risk, especially when combining this with a passive investing strategy using diversified ETFs for the long term.

The first part of my conservative margin investing strategy involves maintaining a low LVR, this seems obvious but it is critical to avoid the worst case scenario of a margin call. By maintaining a low LVR you make the change of a margin call extremely rare (but still not impossible of course), whilst still getting good amplified returns. Personally I think a good balance is at around 35% LVR as you’re turning a 8% return into 10% return and it would take a market drop of over 50% before you would be hit with a margin call. However this is dependent on your exact investments but if you are investing in diversified ETFs of around 70% max LVR this should be the case. A 50% drop in the entire market is obviously huge and has only happened a few times in history, it never happens instantly and having this buffer allows you to plan on how you may address this event in the unlikely case it does occur.

The second part of my conservative margin investing strategy is to stick to diversified ETFs that provide high maximum LVRs with your margin lender of at least 60-70%, this will 1) further reduce your risk of a margin call as your will have a larger buffer and 2) provide you with appropriate diversification for long term growth.

The third part is that it is a long term strategy, you cannot apply this strategy effectively unless your investment time period is long enough to ride out any volatility to ensure you get your expected return. I would consider this to be at least 15-20 years. Remember you only need to achieve returns greater than your loan’s interest rate to be getting a net gain and over the long term this is very achievable.

Summary

So there you have it that’s my passive margin loan investing strategy. Really it just depends on your risk tolerance and whether your investment period is long enough to ride out any short term market volatility. Definitely something to consider if you tick these boxes especially when you factor in the tax benefits.

Let me know in the comments if you have any questions.